With New Zealand publishing its sovereign green bond framework this week, green or environmental, social, and governance (ESG) themed govvie bond benchmarks are now established, or soon will be, in eight of the G10 currencies.

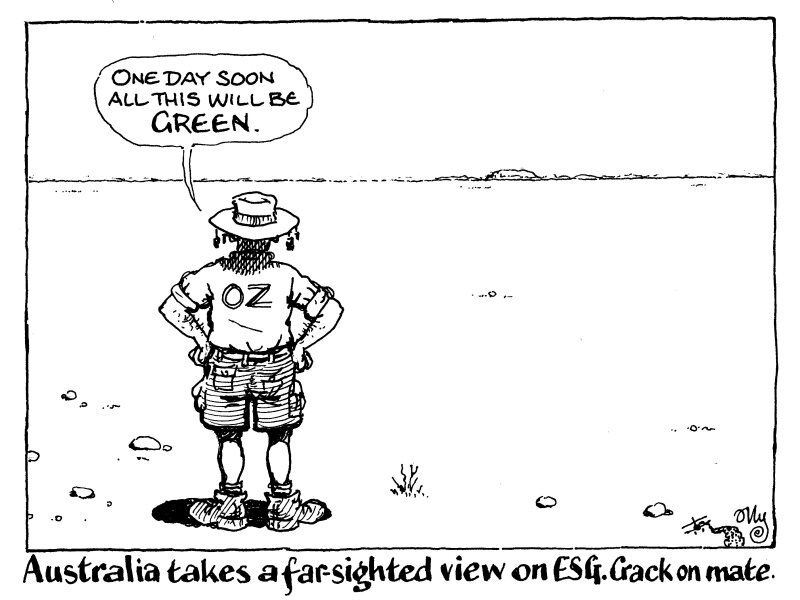

Soon the Australian and US dollars will be the only G10 currencies with green sovereign bond holdouts. Although there was hope that US president Joe Biden would pursue a green agenda, he has made no steps yet to green the US Treasury market.

However, things look a little brighter for Australia, where recently elected Labour prime minister Anthony Albanese appears more open to combating climate change than the previous Liberal government, headed by coal cuddler Scott Morrison.

Despite Albanese’s eagerness to enshrine climate commitments into law, there are still climate hurdles that would make Australia a questionable issuer of labelled debt.

For instance, over the last year, coal was used to generate 59.3% of the electricity for Australia's national grid. Furthermore, the country is heavily dependent on a controversial mining sector that accounts for close to 10% of its GDP.

But if Canada — also in the G10 and the largest oil and gas producing country to issue green debt — can begin its own green bond journey, then there is no reason why Australia can't.

Perhaps an Aussie green bond would draw accusations of greenwashing. However, Australia’s debt is already under scrutiny from investors for its dearth of ESG awareness.

The sovereign is embroiled in a two year and counting legal challenge from a retail government bond investor over its lack of climate risk disclosure. Furthermore, the treasury itself is concerned that its funding costs could rise 100bp-300bp by 2050 if it is not seen to take a firm stance on climate change.

If the new government is eager to show its green credentials sooner rather than later — and save its future taxpayers money — then it should make a financial commitment towards issuing green debt and avoid being left behind in the green funding transition.

Now’s the time to stop talking and get printing.