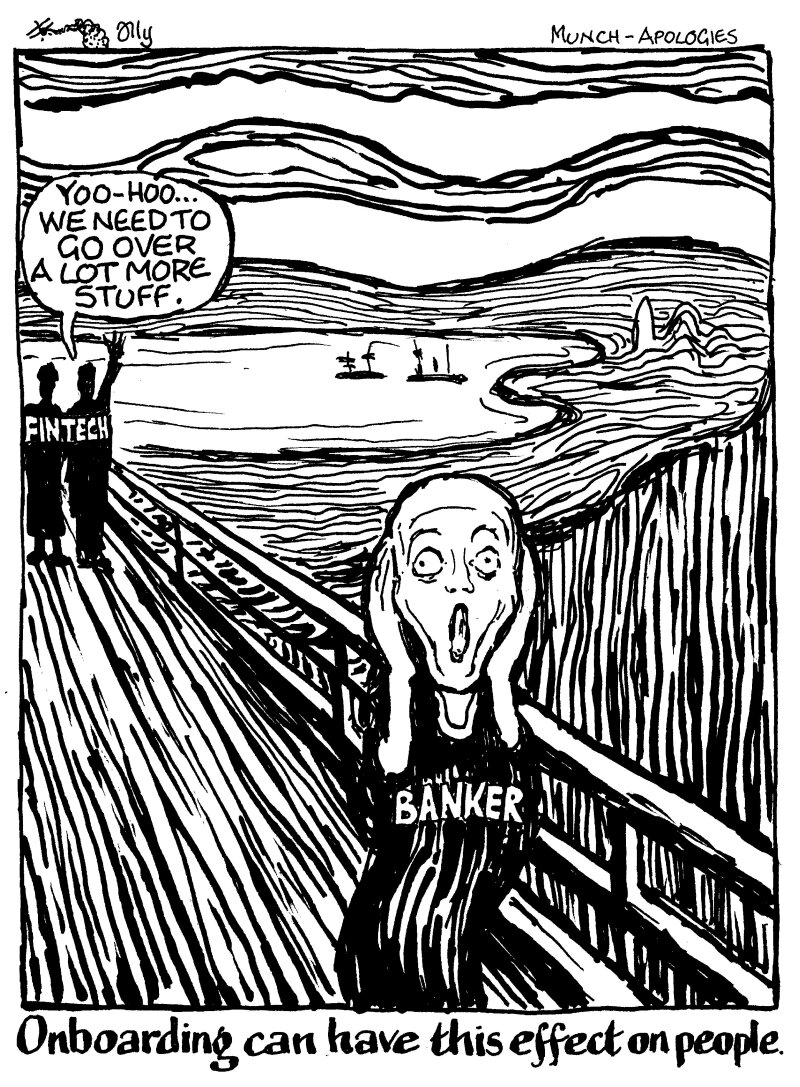

For every gallant attempt to bring technological efficiency to the capital markets, there is an equal and opposite force holding up progress: onboarding.

Onboarding refers to the process by which the banks looking to benefit from fintech companies' products and services is brought on to the system. The bureaucracy is heavy going, involving regulatory and procurement compliance, security concerns, technological compatibility, and risk for every client who opts in. It can take anything up to a year to plough through and requires a lot of resources — both human and financial — to complete.

It raises the question whether it is worth the bother. In such a fragmented marketplace with tens of start-ups claiming to offer solutions for every different part of the capital markets, is it even saving the banks time or money to sign up?

The question becomes even more poignant given the prospect of consolidation in the industry. In any fledgling sector, where several similar companies are vying for position and attempting to dominate, companies will swallow each other as the successful buy-up their rivals.

This means that during the course of a year-long onboarding procedure, the fintech in question could be devoured, entirely derailing or negating the process.

It isn’t an attractive prospect and is likely one that is slowing down adoption.

But the fundamental problem is that the process seemingly cannot be streamlined. Onboarding takes time because it is important.

"Information security teams need to do what information security teams do," said one prominent fintech founder. "They need to know your back-up plan and need a 400 line Excel spreadsheet to prove it, none of which are the same across clients.”

Even if the questions are common between the fintechs, the dialect each bank answers in is its own limiting the possibility of a universal approach. “It is a torturous process, and yes we'd all love it if there was some way of speeding that up," said the fintech founder. "But I can't see it happening anytime soon.”

While it can be argued that the golden ticket in this industry is to design the interface that makes all onboarding processes a one-time concern, this does not yet exist.

For all the promises of capital markets tech; simply getting to the point where it can be used is negating much of the benefit of having it in the first place.