Guatemala’s $500m seven year deal rather woke EM bond bankers from a stupor this week. After a torrid year, several were consoling themselves with the idea that they could at least fully unwind on extended summer holidays, with no danger of primary action to bother them.

Perhaps this is why many are struggling to get excited about Guatemala — despite it being the first Latin American sovereign benchmark-sized deal since March and the first benchmark trade from any type of sub-investment grade issuer from the region since early May.

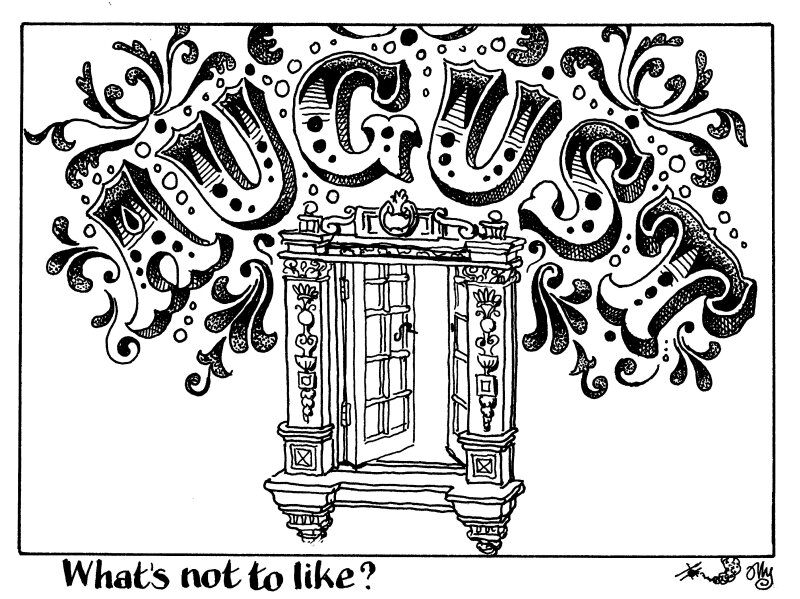

Yet the Guatemala deal is significant, and not just because it shows that deals — even high yield ones — can get done. Above all, it is a compelling signal that those that can go in August should do so.

There is plenty of reason to think markets could turn sour at any moment — not least next week’s US CPI data — but the fact that the window may be short-lived is no reason not to try to jump through it. Rather, it is a reason to accelerate plans.

Developed market companies see this, as evidenced by the bustling US corporate bond market. Only a select few EM issuers can bring bonds as quickly as US issuers, but they should still make sure they are ready to go at short notice.

Revisiting the market in September, a more traditional issuance window, seems to be the popular choice but it is a risk. It is a month that can often be volatile even in the good times, as it is full of economic data releases, central bank meetings and other market moving events, not to mention a truckload of competing supply. If you believe we are still mid-bear market, September would be an odd choice.

For the past year, waiting for a better window has consistently proved to be a mistake for EM borrowers. There is nothing to suggest that is about to change. Issuers should remember that relaxing by the pool is far more relaxing when funding is complete.