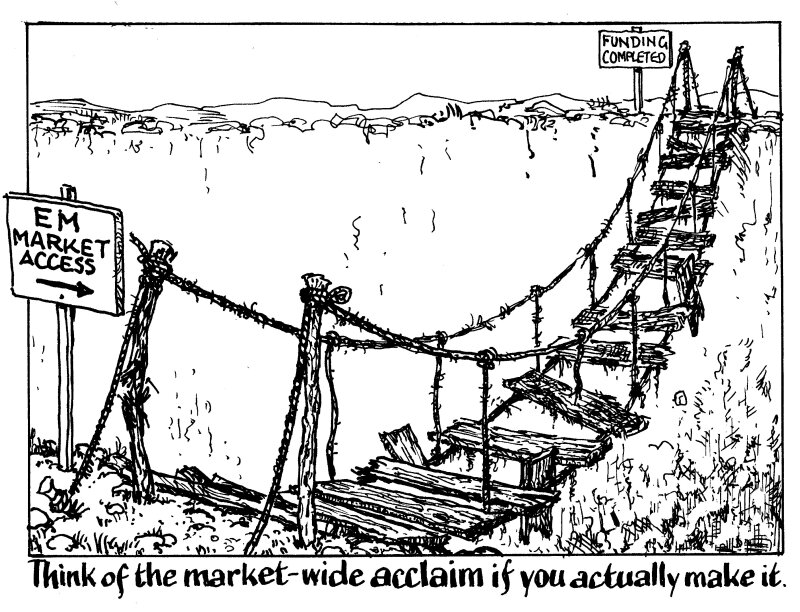

Market conditions are not conducive to new EM bond issues. The US rates sell-off has pushed yields to levels not seen for years and even US corporate borrowers are paying huge new issue concessions.

With a handful of exceptions, most EM issuers appear paralysed by the surge in their cost of funding and the wild volatility in markets and don’t want to take the risk of announcing bond plans. After all, in the good old days, a deal not materialising — or even just failing to generate pricing tension — could be a source of gleeful gossip for other market participants.

But the idea that a pulled deal is a source of shame is outmoded. It is time for EM borrowers to swallow their pride, hit the Zoom and Webex screens, and sound out investors about new deals.

Sure, not everything will catch a big bid, let alone be priced first time round. And for the deals that do make it, issuers will have to pay higher premiums but so what?

Yields are only going up and spreads wider and there is no end in sight to the volatility. If you have funding that you need to do, as every bond trader knows, the first cut is the cheapest.

Bond markets were in bad shape even before talk of a global recession emerged. This is not a time to attempt the perfect syndication. The new bar for success is getting the funding done and there have been so many rough new issues of late that any embarrassment will be widespread.

Even issuers who simply roadshow will gain something. In today’s illiquid secondary market, any pricing feedback from investors is valuable.

There is nothing to lose from venturing out into stormy markets. These days, a roadshow doesn’t even require an issuer to put their shoes on, let alone leave the house. But for those that don’t get their skates on, waiting could lead to a nasty slip.