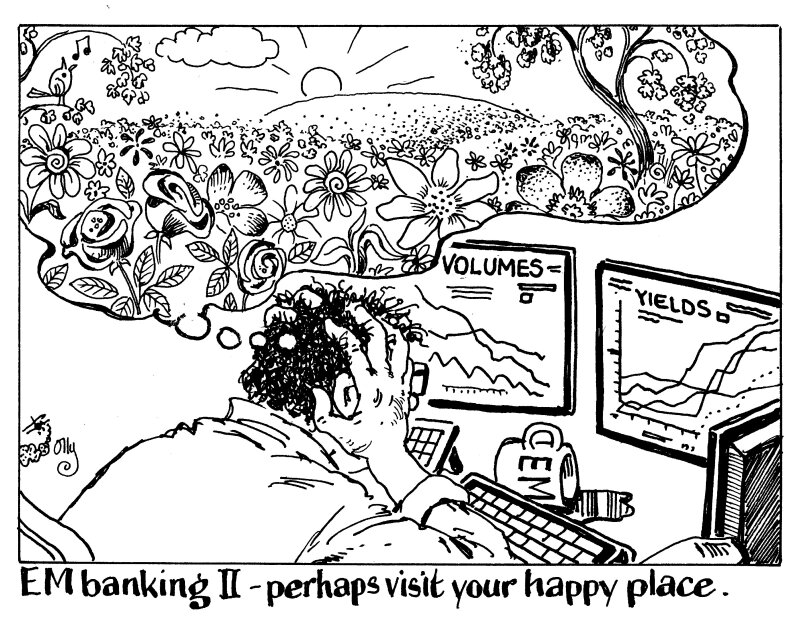

EM bond bankers are miserable, and understandably so. On both sides of the Atlantic, they are seeing the worst volumes in years and are not holding back when describing the state of the market. “Broken” was the choice of one LatAm DCM head on Thursday.

Yet EM bond markets are not “broken” — in fact, they are functioning. For despite the doom and gloom, deals are being priced, even on unimaginably bad days in global markets.

The difficult bit is not getting a bond priced exactly, but finding an EM issuer willing pay what’s required to do so, with average EM sovereign yields having peaked above 7% for just the fourth time since 2009 and new issue concessions extortionate.

Unfortunately, the fact markets are functioning is perhaps a worrying sign. EM outflows are accelerating but investors are far from panic stations. Indeed, the EMBI+ index of liquid EM sovereign hard currency bonds is down 16% year-to-date, putting it broadly in line with global stock markets, so not a terrible result.

In fact, spread widening has been mostly mild — the increase in funding costs and the index being in the red is mostly down to the US Treasury sell-off on one hand and volatility-driven new issue concessions on the other.

This is a scary thought, because it suggests the market is not yet pricing in the increase in EM risk premia versus developed markets that would be highly likely if today’s macro worries escalate. And these worries are indeed escalating, with concerns building that the rates, inflation, and war headwinds could morph into a major economic growth problem and potential recession.

If that happens, it really will be time for EM bond bankers to buckle up.