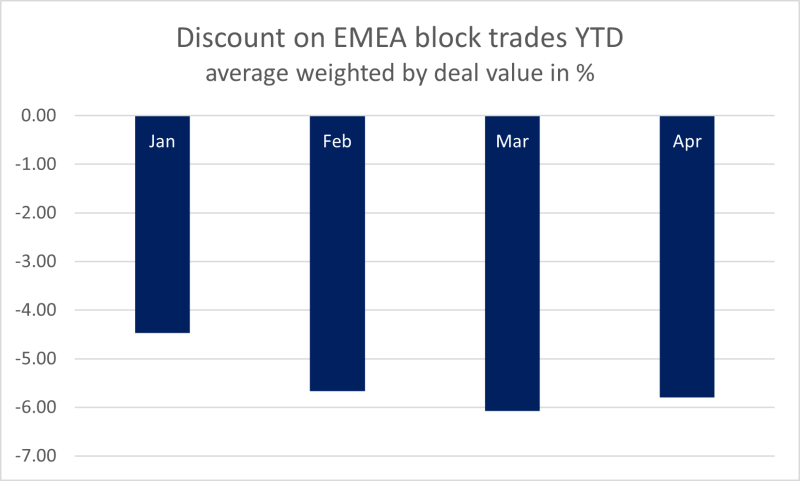

Block trade performance suggests that conditions are improving in the EMEA equity capital markets. In April, the trend of increasing discounts offered to investors reversed for the first time this year, according to a GlobalCapital analysis of Dealogic data.

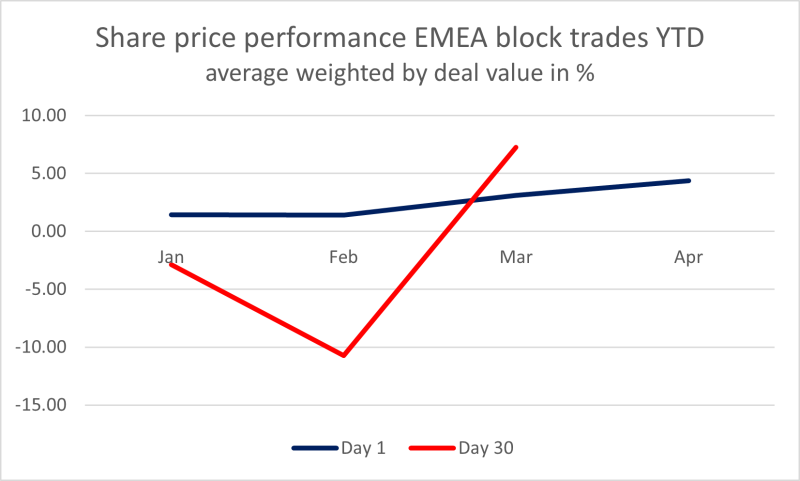

The performance of shares sold in accelerated book builds has been improving since March, when measured both one day and one month after the deal.

Sellers are becoming bolder, too, in coming to the market with larger stakes. The average size of a block sale increased from $56m in February to $167m in March. In April so far, it has fallen to $112m, but is still far above the cautious, small trades at the times of peak volatility.

In April, the market has moved on from the sorts of block trades in companies that proliferated in the immediate aftermath of the invasion of Ukraine, namely those whose businesses benefitted. Those were in companies that deal in commodities like Glencore, energy like Energean and fertilisers like Israel Chemicals.

But these deals no longer dominate accelerated book builds. Instead of cashing in on unexpected gains, investors have shifted towards dumping unwanted shares in a growing number of undisclosed deals in the past weeks.

Mystery owners cut stakes in E.On, Commerzbank, Deutsche Bank and Barclays in a volatile market. "Sellers do not want to make a splash in case it does not all go according to plan, so if there is not a genuine need to disclose, then sellers are saying why disclose," said an ECM lawyer. "If it works well great, but if not, sellers do not want egg on their faces."

In the EMEA region, 142 block trades have raised $19bn for their sellers this year to date.

This is the lowest total deal value for the period since 2010, but still looks like a froth of activity compared to the moribund IPO market, which was scuttled by volatility after the invasion of Ukraine and has only been saved from being a complete disaster by a number of large deals in the Middle East.

Shortly after the beginning of the war, opportunistic sellers reopened the blocks market, off-loading small stakes in companies that benefited from the invasion at steep discounts.

The most striking example was KKR selling €207m of shares in the German defence company Hensoldt. Its stock price doubled within days after German chancellor Olaf Scholz announced a huge boost to military spending and the deal was priced at an extremely wide discount of 18.1%.

Block trades, especially overnight deals with no exposure to daytime trading, were the only viable option for investors to react to the rapidly changing geopolitical situation of the past months.

With volatility back on the rise — the Cboe Volatility Index (VIX) surged back to 31 on Tuesday — they are likely to be the dominant form of ECM activity for the coming weeks.

But their improving performance is a first sign that markets are finding their rhythm under circumstances that have dramatically changed since the beginning of the year.