In the excitement over the supposed snub of Germany’s flagship investment bank by one of the country’s blue chip car brands, observers may have read too much into what is, after all, a single flotation.

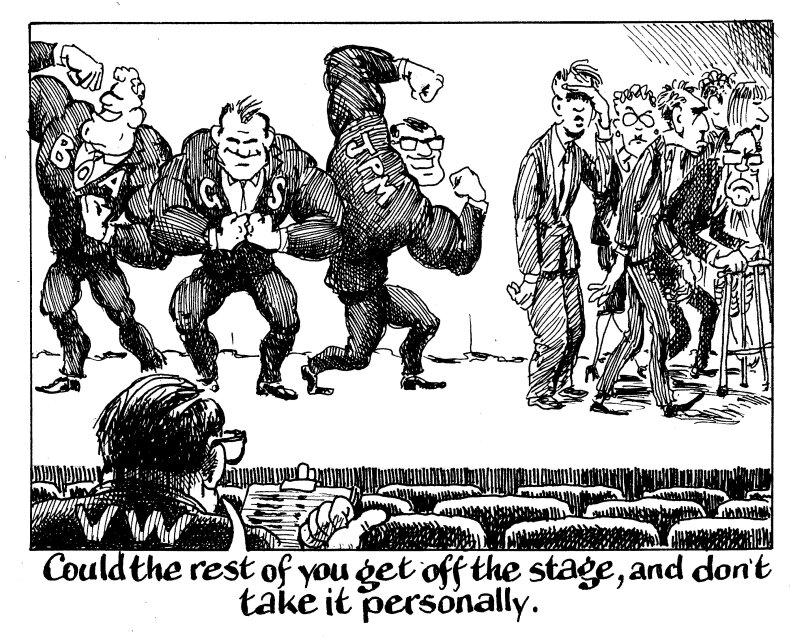

Last year, the top five slots in the EMEA equity capital markets league table were occupied by Goldman Sachs, JP Morgan, Morgan Stanley, Citi and Bank of America.

VW has picked four of them — Goldman, JP Morgan, Citi and BofA — to lead the spin-off of Porsche, one of the biggest initial public offerings in Frankfurt in a decade.

The choice is eminently justifiable. There is no rule that says VW has to pick Deutsche Bank.

Morgan Stanley, for its part, is widely thought to have been sidelined as retribution for pulling back from financing VW in the wake of the ‘Dieselgate’ scandal.

A source at VW strongly denied any such thing to GlobalCapital, casting the selection process as a purely meritocratic one.

“Appointing a European bank just because we’re a European company would be weird, no?” added the VW source. “We just chose the ones that suited best.”

Some in the market may find that hard to believe.

But whatever VW’s motivation, a single mandate, even a prestigious one, does not tell the whole story of a market.

European banks have made steady progress in closing the gap with their US rivals in the past couple of years. Four out of the five US bulge bracket banks lost market share last year.

While BNP Paribas is snapping at Citi and BofA's heels, Deutsche has also been rebuilding its presence in its home market and is looking forward to leading on big German IPOs from Ottobock, Schott Pharma and lender OLB.

Missing the Porsche mandate may turn out to be just a bump in the road.