The fate of Russia’s sovereign debt is the topic of the week in emerging markets. It has been, as Winston Churchill described the country itself, “a riddle, wrapped in a mystery, inside an enigma”. But Russia’s aims in paying may be altogether more simple.

Whether this week’s coupon payments eventually reach all investors or not, the curious part is Russia’s motivation in making coupon payments to Western investors, all while engaging in war with the West and while the Western financial system is doing all it can to strangle the Russian economy.

A country repays its debt to show the world, on one hand, that it is true to its word and respects contracts, and on the other that it is an economically stable place that deserves investment — whether in bond markets or the real economy.

Sometimes, even the most financially squeezed governments make bond payments, because they calculate that it would be more costly to renege on their obligations — harming investment and economic prospects in the country, and destroying their reputation as a sovereign borrower.

But which of these incentives applies to Russia? If Russian president Vladimir Putin cared about Russia’s standing among European or US institutional investors, he would not have invaded Ukraine in the first place. Russia’s reputation in markets is already in tatters.

Even if it were to somehow retain a spotless debt repayment record throughout the war, the Russian sovereign will not regain international bond market access under this regime. Investment by European and US companies in the Russian economy is quickly dwindling to zero.

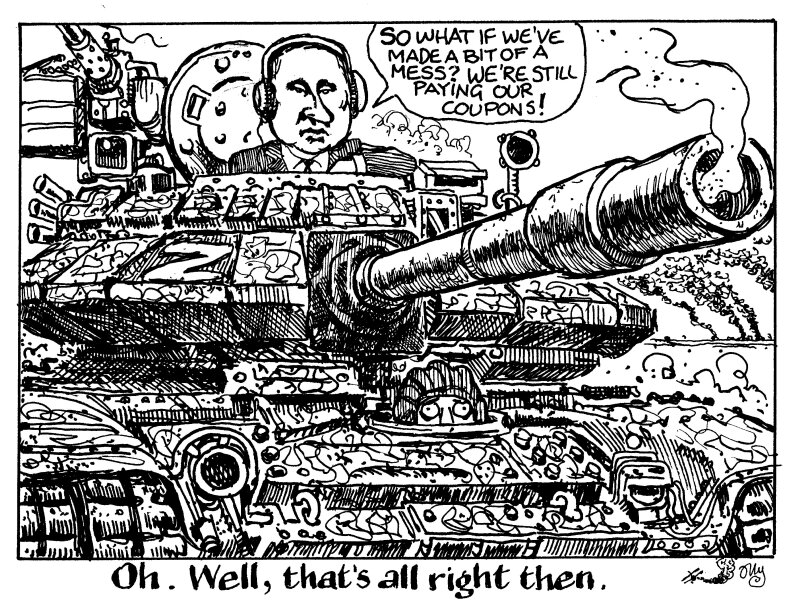

For Russia to claim it actually cares about repaying its Western creditors while carrying on with the invasion is utterly absurd. Some think it’s a point of pride for Russia to continue to be able to boast that it’s a country that pays its debts. It may be true that they don’t want the additional headache of thinking about what a sovereign default might mean.

About the only reasonable answer seems to be that if Russia is cut off from Western finance, then certainly it will want to show other potential creditors that it tried its best to pay, so that it is not faced with punitive terms.

In any case, by attempting to make its coupon payments, Russia is insinuating that its relations — as far as it is concerned — with international financial markets should be viewed as business-as-usual. Therefore, it cannot be held accountable for disruption in bond markets caused by delayed payments, for which it will blame Western sanctions. Its finance minister argues that if the money it has deposited does not reach bondholders, it is the West’s fault.

Paying the bonds is not coherent with Russia’s economic and financial situation. It is, however, coherent with the regime’s argument that Russia is not to blame for events in Ukraine — or their consequences.