Oil and gas companies have had an unspectacular decade in terms of share performance in Europe. The Stoxx 600 Oil & Gas was at €346 in price terms a decade ago. It is around €296 this month, having recovered from a dip that took it to a 23 year low during the pandemic.

In the industry's favour since the nadir of the pandemic in 2020 have been the rocketing prices of the fuel it supplies, as energy demand has soared as the world came out of lockdown.

Normally, that would show up in oil and gas companies' share prices. Indeed, companies like Exxon and BP have reported high earnings and the oil and gas index has outperformed the overall Stoxx 600. But it has still underperformed compared to the amount the oil price has risen.

Experts explain this away by talking about an ESG risk premium — that investors now discount the share price by an amount they believe takes into account the risk to future earnings from the move away from fossil fuels.

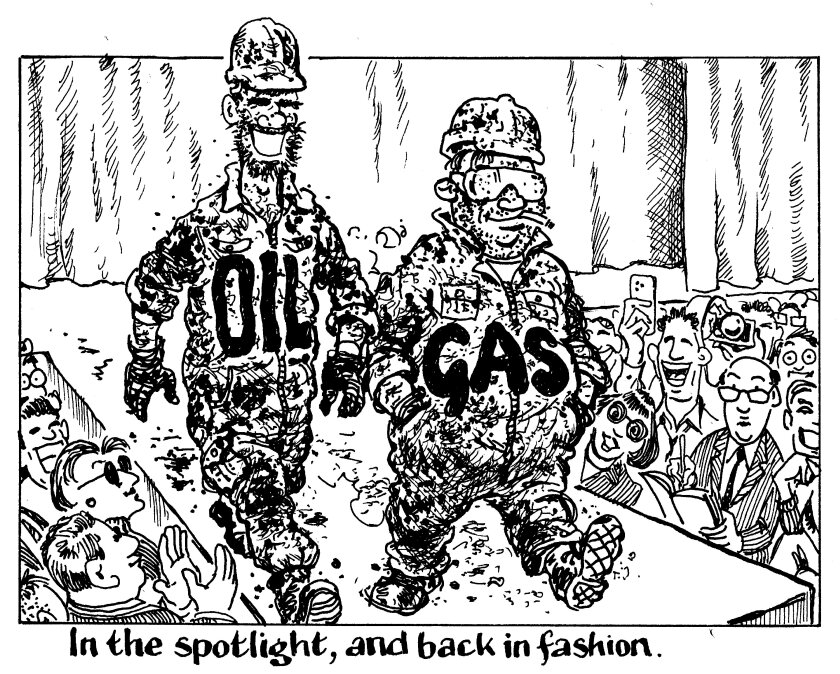

But this is not the end of the story. High inflation has deterred investors from growth companies and tech stocks and sent them back into what one banker called "true cyclicals" as they look to get in on the economic recovery from the pandemic. Further, the shares of several of the growth companies that went public last year have performed terribly.

Oil and gas giants are now ripe targets for equity buyers. After all, the green transition is far from complete and the world still runs on oil. There is no sign of high prices of energy commodities in sight and if investors believe these companies' share prices have underperformed compared to the rising price of energy, then there is an argument to say they are trading cheap.

So, while there can be no doubt that the long term future of revenue from fossil fuels is extinction, energy companies have a golden moment to raise equity capital while their market is booming. And perhaps this could be the last such opportunity they will have.

It is hard to imagine another crisis as severe as the pandemic that shuts the world down, only to see energy demand spike so suddenly as it opens back up again.

Meanwhile, alternative energy sources make up an ever bigger part of the energy mix and investors are ruling out polluting investments with ever more seriousness.

This is a big chance for energy companies to raise capital, and if they do it to fund their own transition to green energy, so much the better.