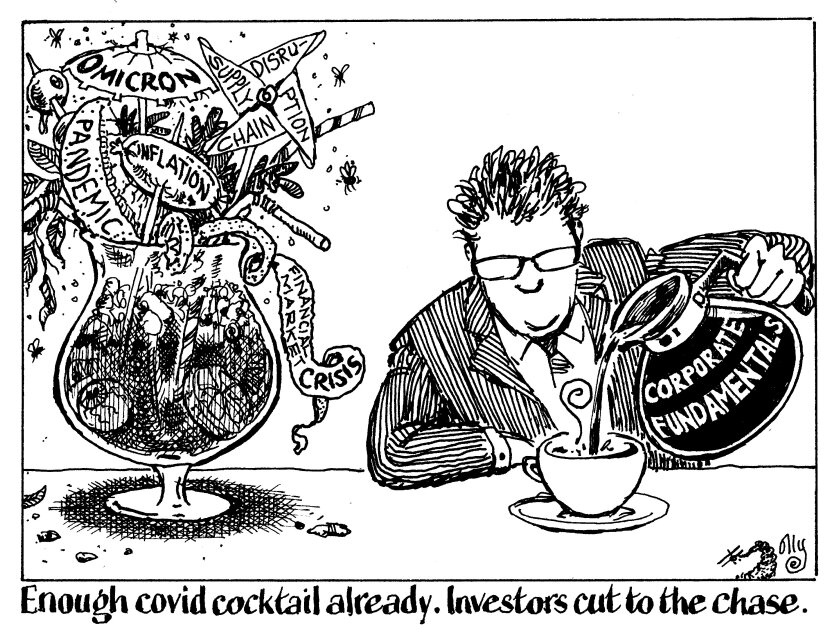

It has been a rough two years. First, the pandemic threw financial markets into the worst crisis since 2008 and then, just when economies started to recover, they have had inflation, supply chain disruption and now Omicron to contend with.

But investors appear unfazed. Rising tensions between Ukraine and Russia have not had much of an effect on indices. The Moscow Stock Exchange has instead identified the education of retail investors as its greatest challenge in 2022.

Even Omicron has caused just a temporary hiccup so far. The FTSE 100, Euronext 100, the German DAX, and the French CAC 40 have all recouped around half their falls last Friday, and are trading comfortably above their levels at the beginning of the year.

On the face of it, rising indices in bad times is a tale as old as quantitative easing itself: investors have an awful lot of money that must be put to work somewhere.

But it used to be said that investors were ignoring fundamentals and buying stocks indiscriminately on the basis that QE was a tide that lifted all boats.

Now, it is different. Senior equity capital markets bankers insist that corporate earnings are once again the biggest driver of stock performance, which means that investors are looking beyond the macro to how a company is actually performing.

Of course, no company operates isolated from inflation, the pandemic or any other major economic force and these will influence corporate performance. But by bringing more scrutiny to earnings, investors are going to be better able to pick the wheat from the chaff.

That is just as well. Morgan Stanley might well forecast a 10% growth in corporate earnings across Europe next year but it seems more likely that central bank monetary policy will tighten than not, and that the support measures put in place during the pandemic will be withdrawn.

That is sure to leave some companies more vulnerable than others. As Warren Buffet famously said, “only when the tide goes out do you discover who has been swimming naked”.

It's a good job investors have got their binoculars out.