Conditions in the primary bond markets are becoming more difficult and they will get worse yet as central banks begin to tighten monetary policy to combat runaway inflation.

For so long, the process of selling new bond issues — particularly in the sovereign, supranational and agency bond market — has been a more straightforward task than in decades gone by due to the extremely loose monetary policy of central banks.

With rates at rock bottom and central banks sucking up vast quantities of SSA debt, there was never a question over demand. But this is about to change as the likes of the European Central Bank and the US Federal Reserve begin the tightening cycle, as inflation shoots up.

Investors are finally showing signs of wariness over what lies in store in the primary bond markets. Several new issues in the SSA market this week, for example, received lacklustre demand and were unable to tighten their spreads from guidance.

Investors have cash available but do not want to lock in yields now that will look rich in the near future. The ECB's monetary policy meeting in December is a key date in the diary when the central bank is expected to make big announcements about how much tighter its policy outlook will go.

Some SSA issuers this year mounted an attack on the fees they pay their lead managers, arguing that the easy monetary conditions had nullified underwriting risk. It’s a valid point, but on the other hand, fees are paid for other services too, like secondary market support.

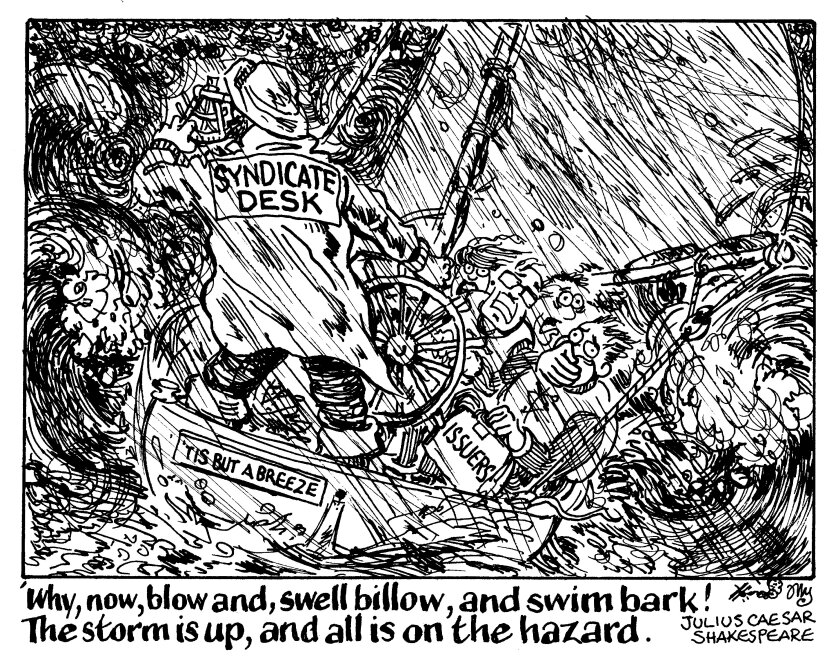

If the contention on fees is about underwriting risk, then this will be turned on its head as central banks tighten monetary policy. Bond syndicate desks will earn every cent of their fees getting their clients through tough times.