It might seem crazy in this era of negative yields and historically low interest rates, but there are some people out there who still think bond issuers may be overpaying for debt.

One of them is Selim Mehrez, who recently set up an advisory boutique in Paris with his wife Kaouthar Mehrez and business partner Eric Souny, who was previously deputy CFO of French retailer Casino.

Kaouthar Mehrez used to be head of emerging markets debt capital markets origination at Natixis, so she knows a thing or two about pricing bonds.

Selim Mehrez says one of the goals of the new firm, which is called Galite Partners, is to "make sure that issuers pay the right coupon, and we don't want them to pay more than they should.”

Of course, it is hardly a new idea to point out that bond underwriters have an interest in making sure that the wares fly off the shelves. They put their balance sheet on the line to support their clients' debt offerings, but they would rather not have to use it. A large oversubscription ratio on a deal may be a sign that an issuer has left money on the table.

And just because yields are low, doesn't mean issuers should settle for pricing that is wider than necessary. An eighth of a percentage point easily translates into millions of euros or dollars.

On the other hand, syndicate bankers might point out that it is only through constant dialogue with investors via a sales team distributing hundreds of deals a year that the real appetite for a particular issuer's bond can be gauged. And furthermore, for an issuer looking for repeat access to the capital markets over time, fighting tooth and nail over every last basis point may not be the wisest move.

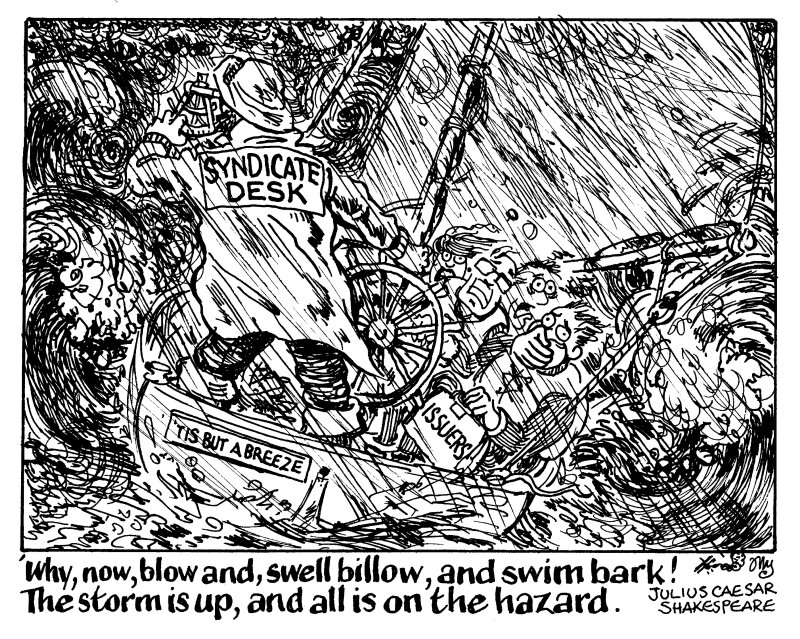

In any case, as GlobalCapital points out in its leader this week, the era of plain sailing in the primary bond market looks like it is nearing an end, and syndicate managers will soon start have to earn their fees by helping clients through more challenging conditions.

ESG talent war rages on

An era that shows no sign of coming to an end is that of environmental, social and governance concerns. This has been reflected in the past few weeks in the never ending flow of bankers into sustainability jobs.

NordLB, for instance, just moved an official from its funding team into DCM as head of sustainable bond origination. The banker, Philipp Bank, will build on his experience working on the German lender's own green bond framework.

And while much of the focus has been on capital markets originators, the trend does not stop there. JP Morgan recently created a global markets sustainability centre within its structuring and solutions division.

The demand for bankers with knowledge of sustainability topics is fuelling hiring from one bank to another. To lead its new sustainable markets team, JPM hired Paris-based Neven Graillat from BNP Paribas, where he had been chief sustainable product officer.

Meanwhile, Leonie Shreve has just left her role as global head of sustainable finance at ING, destination as yet unknown.

More People News

-

The supranational funding supremo is moving into a part time role

-

Weinig to leave this year to explore another opportunity

-

JP Morgan is second in the EMEA ECM league table this year amid a booming IPO market globally

-

Michael Spitzner joins Dutch bank in Frankfurt

-

Roshan Sukhwani will work in Madrid under Carlos Godina

-

The headcount of the practice, established in 2017, has tripled in the past few months