With buy-side and sell-side alike free to enjoy an actual summer holiday, Latin America bond bankers had promised a proper break in issuance for August. They duly delivered. Just two Lat Am issuers have tapped bond markets so far this month, and none since August 5.

Meanwhile, in both the US and Europe, corporate issuers have flocked to primary markets, with some companies accelerating funding plans in an effort to guard against future rate rises.

Bankers say that because only a handful of Lat Am borrowers tap markets more than once or twice a year, they prefer to wait until September, when investors are certain to be around and the greater liquidity makes for sharper pricing.

Yet there is ample evidence both in other markets and previous Augusts in emerging markets that deals can get done — especially from well-known credits.

The Lat Am market let perfect be the enemy of good this year. Such overthinking of the timing of deals could prove to be a mistake for some Lat Am borrowers.

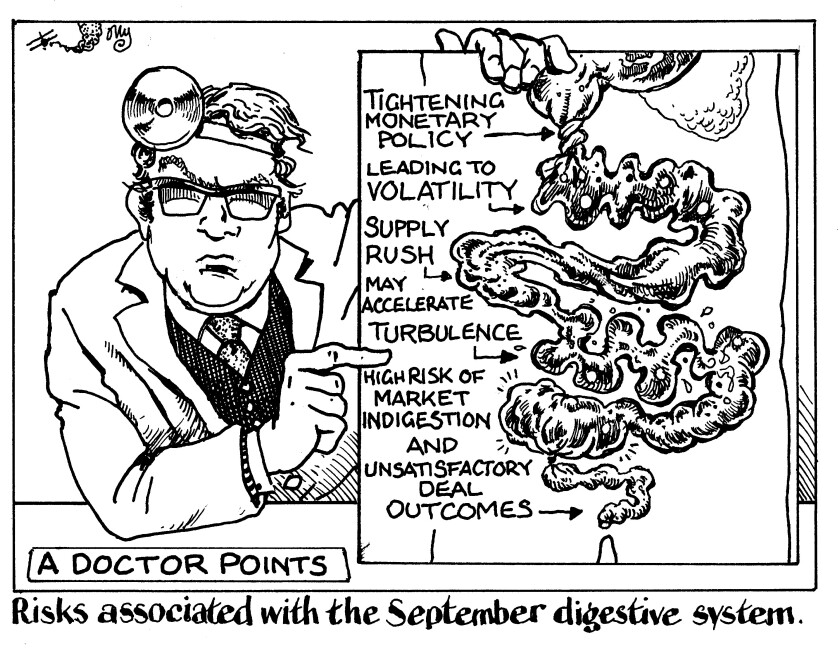

First, the back-to-school trade can work both ways. With US Treasury yields still lingering well below most banks’ year-end forecasts, and EM spreads having barely budged during August, it’s not obvious that investors will get back to their desks and decide there is screaming value to be had. Today’s attractive funding costs may not last.

Second, September does not always go to plan. In 2020, the September idyll lasted until the 18th, when a clutch of borrowers began to postpone deals as rising coronavirus infections and indigestion from hefty supply became too much to bear.

These two risks persist. Virus concerns linger, while another heavy calendar of Lat Am issuance is expected from both sovereigns and corporates.

There is a third risk too, and perhaps the biggest of all for bond markets, with the US Federal Reserve mulling whether to trim its bond buying.

A supply rush may therefore accelerate the return of turbulence in Latin America. Several of the region’s borrowers may end up regretting not making hay while the sun shone.