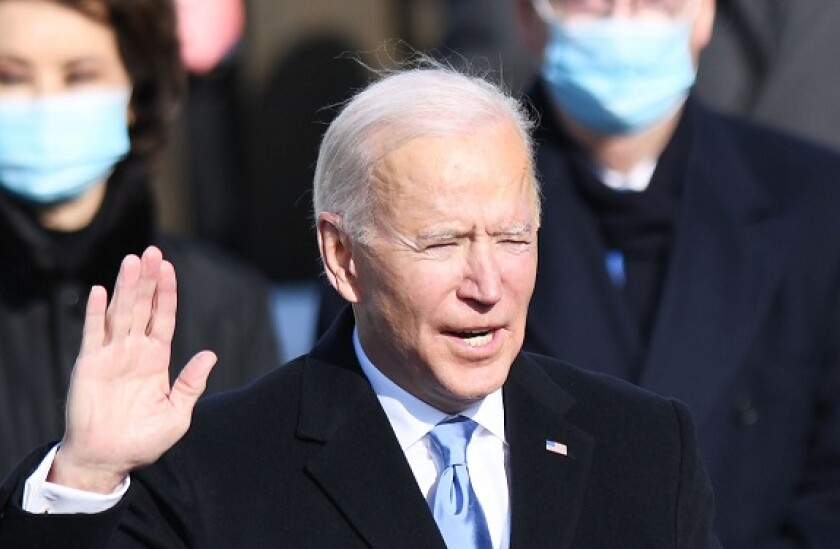

Biden looks like wasting no time — he signed the US’s rejoining of the Paris Agreement on his first night in the White House.

But what will this era bring for capital markets? Market participants in the US may be tempted to reply: inflation — the long delayed result of an extraordinarily large expansion in the money supply.

Since March 2020, central banks have found a new overdrive gear for money printing. Many observers are alarmed that it has squashed the markets’ usual ability to discriminate between and price risks. They prophesy that it can only end in a cataclysmic crash — the trigger for which could be a resurgence of inflation, forcing central banks to turn off the taps.

No one can be sure the doom-mongers are wrong. Asset prices are at probably their most extraordinary levels ever. The US economy is estimated to have shrunk 4.3% last year, yet the stockmarket rose 16%. There will be catch-up growth this year, but most of that is asset price inflation.

In bond markets, “froth” is back in the conversation. Primary bond markets are, with the possible exception of the financial institutions sector, red hot. The Kingdom of Spain’s (briefly) €130bn order book last week showed just how sweaty conditions have become. While that shows investors are still gluttons for bonds, the desperation is beginning to look like a late cycle mania.

US Treasury traders certainly think something is afoot. Since new year, the 10 year yield has skipped from below 0.95% to as high as 1.15%. Is air beginning to escape from the 40 year bond bubble?

Biden’s planned $1.9tr reflationary fiscal boost helps to account for the Treasury sell-off; gold and bitcoin are riding high.

Despite the recent move, bonds are still in the pandemic deep freeze — the 10 year yielded 1.8% before it began. But inflation breakevens at 2.1% are close to their highest in the past five years. If those expectations are right, bond yields have further to climb — indeed, if all the stimulus works, they have to rise.

That will be uncomfortable, and could be very painful for emerging markets. Would it be a disaster? Not at all — for the time being. Bond investors have been through worse before.

Inflation may still be the bogeyman who stalks their dreams, but in broad daylight it has been a poor, enfeebled creature for years.

As has become normal in the past decade, Europe is sluggish and downbeat by comparison. The ‘era of the ECB’ is still in full swing. Five year euro inflation expectations rose above 1.35% last week, but the market is ignoring it: the 10 year Bund is stuck at -0.52%.

But if the vaccines really do prove efficacious against the coronavirus, the Biden administration — and the Federal Reserve — will before long have to deal with a financial market that needs cooling.

Mainstream bond investors can cope. The difficult bit will be finding a way to stop the equity inflation without causing a panic — and being ready to deal with the overleveraged weak borrowers when the rug starts moving under them.