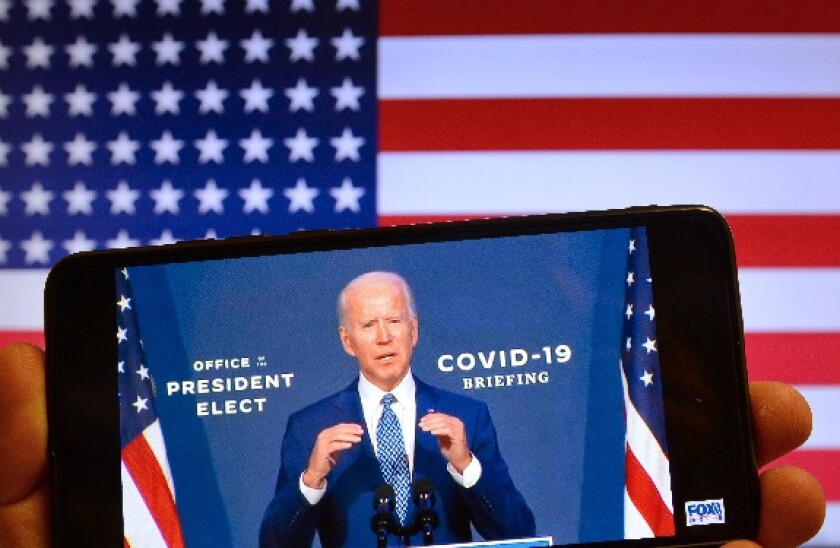

As the world prepares for the presidency of Joe Biden — albeit with some alarm about Donald Trump's refusal to concede — the Talking Politics podcast, with David Runciman and Helen Thompson, takes a look at what the key themes of his time in office are likely to be.

Covid-19 is obviously one, although Biden might have the good fortune of taking charge just before a vaccine is rolled out and the economy recovers.

Beyond that, Trump's harder line on China looks likely survive his administration. The issue of regulating big technology companies is also likely to become even more political.

Then there is climate change, where Biden may struggle to implement an ambitious domestic agenda given that the Senate will either have a very slim Democratic majority, or the Republicans will have control, depending on the results of two special elections in Georgia in January.

Much has been said and written about what Trump means for democratic backsliding in the US, and whether Biden will reverse that. TalkingPolitics offers a (perhaps too) gloomy assessment about the good Biden will bring in the long-run, arguing that the new administration — which for many represents a "return to normality" — may well continue a drift towards incapacity when it comes to the big issues facing democracies.

Whether he represents a return to normality or not, Biden and his victory brought a much needed lift to financial markets this week. So too did news that the Pfizer/BioNTech vaccine has been found to be more than 90% effective.

Until recently, BioNTech was little known outside the worlds of European biotechnology and equity capital markets. But it has become a household name almost overnight as have its its co-founders and husband and wife team Ugur Sahin and Ozlem Tureci. Despite now being billionaires, they live in a modest apartment with their daughter near their office and cycle into work.

This modest lifestyle has struck a chord in Germany as has the fact that the two scientists are of Turkish descent with politicians and conservative websites quick to highlight BioNTech as a shining example of successful integration and the positive forces of immigration.

The tie-up with Pfizer has an interesting personal angle too, according to the New York Times. The partnership has cultivated a close friendship between Sahin and Pfizer CEO Albert Bourla, a Greek, seeing them bond over their shared backgrounds as scientists and immigrants despite the deep antagonism between their two countries.

Meanwhile, Emanuel Kohlscheen and Előd Takáts at the Bank for International Settlements have found a link between bank equity prices and real estate investment trust (REIT) prices. In fact, they say that REIT prices can predict where bank share prices are heading: the change in the REIT index in a given economy is a "significant predictor" of bank index returns in the following month.

They also say that a commercial property factor accounts for about half of the drop in average bank valuations in the great financial crisis and in the coronavirus crisis.

In the first quarter, bank stocks fell by 47% on average, and the decline in the REIT index explains around 26 percentage points of this.

However, the link is less significant in calmer times.

So what does this mean? It suggests regulators could get ahead of crises by monitoring the REIT prices.

"REIT prices can usefully complement supervisory monitoring of real estate exposures," the authors say. "In particular, regulators might use the commercial property factor to identify overheating risks — and fine-tune the application of macroprudential tools."

Finally, Michael Westphal and Shuang Liu propose a form of debt relief for developing countries, where creditor countries would forgive some of the debt in exchange for "clear, verifiable climate action and investments in healthcare".

The authors say that this "climate-health-debt swap" will need multilateral and bilateral creditors to work together.

This comes in the context of a "vicious circle", they say.

"Highly indebted countries have less room to spend on economic recovery and stimulus to alleviate the pandemic’s impacts or insulate against coming shocks, including from climate change," they say. "High debt burdens mean more difficult choices on where to spend, and less funding for climate action means more vulnerability to climate shocks.

"For example, in Fiji, which is highly vulnerable to climate impacts, there has already been a 32% decline in allocation of government funds for climate-related projects."

Such a programme would involve debtor countries putting the unpaid money into a ring-fenced trust fund, complying with the fiduciary standards of the World Bank or other multilateral development banks. This would help to make sure it is transparent and reduce the risk of corruption.

The authors also suggest that countries could reduce the debt principal in line with a country's overall vulnerability to climate change.