But the French insurer’s suggestion of modelling it on the European Stability Mechanism is clever. The great thing about the ESM is it actually exists. Governments, including the sometimes suspicious northerners, have accepted it. And the ESM worked. Along with the European Central Bank, it helped save the euro.

Climate change will be more cataclysmic, even if the worst effects might seem to some less imminent than the perils of the sovereign debt crisis did a few years ago.

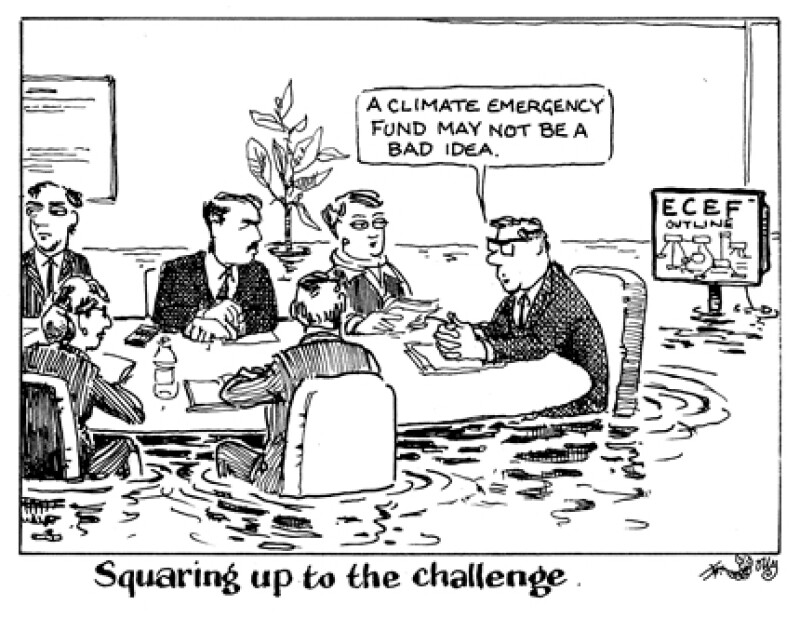

The powerful are beginning to realise it is not enough to mouth platitudes; they need to spend hundreds of billions and to look lively about it.

The obstacles to doing it are not lack of capacity in debt markets, or ways to access them, nor is it cost of debt — which is cheaper than ever. It is the sleepy complacency that pervades the leaders of both governments and private sector firms.

They need to plan and implement huge investments, very quickly. When that is done, and governments take care of the risk through regulation or subsidies, the vast majority of the money will be easy to raise.

Even so, having a great big funding pot like Axa’s European Climate Emergency Fund idea would send a tremendous signal to governments that they did not have to worry about finding the cash.

The EU would help them borrow without scaring the markets and give them reassurance about managing the investments in a fiscally responsible way.

Meanwhile, there are investors with pots of money that need to be in long dated, green assets, of which there are not enough. Axa is no doubt among them.

Axa’s claims about the benefits for the bond market may be stretched, but who cares? For climate change, we need to try every trick there is.