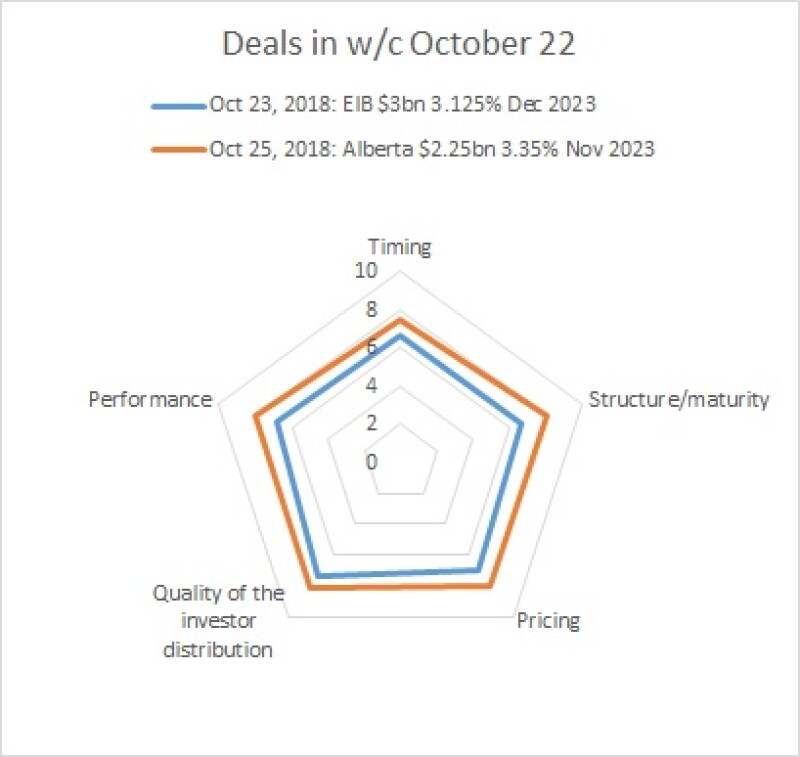

Alberta’s $2.25bn deal, along with EIB’s $3bn trade the only deals to be scored in the week commencing October 22, took an overall average of 7.93. Its best category was quality of investor distribution, which took 8.13.

EIB scored an overall average of 6.90, with the deal let down on timing and structure/maturity, both on 6.67. On-looking bankers at the time said they were surprised EIB had opted for a five year trade.

One banker at the time said he thought EIB should have been able to price at 5bp rather than 6bp over mid-swaps, but BondMarker voters seemed to disagree, giving the trade a 7.00 for pricing.

Last week’s deals — EAA’s $1bn three year, Hamburg’s €1.25bn 20 year, KfW’s €5bn five year, OeKB’s $1bn five year and SEK’s $1bn three year — are available for scoring until Thursday this week.