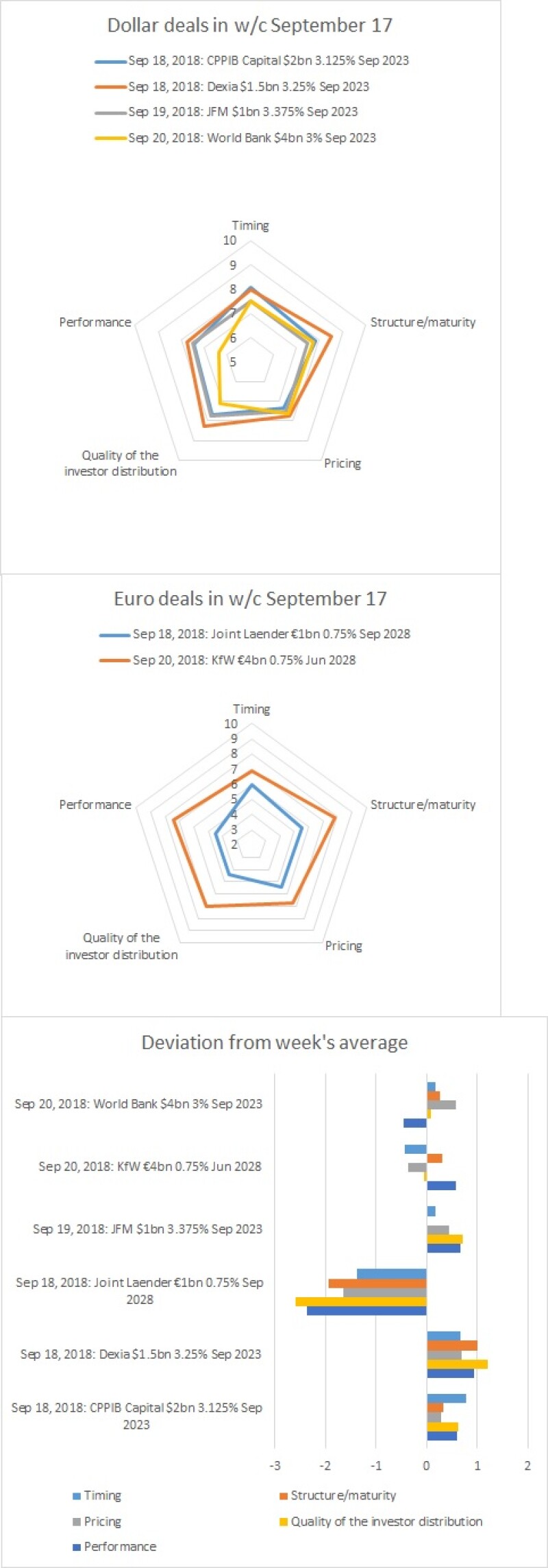

The Joint Laender’s €1bn September 2028 scored an overall average of 5.16 across the five voting categories (timing, structure/maturity, pricing, quality of the investor distribution and performance), the lowest of the deals in the week commencing September 17 and one of the poorest scoring trades of the year so far.

Bankers at the time said marketing at too tight a price was to blame for the deal's undersubscription. But BondMarker voters punished it most heavily on the quality of the investor book and performance (both 4.45).

KfW’s €4bn June 2028 was the only other euro benchmark scored that week and while it received a respectable 7.16 overall, it was the second poorest scorer behind a quartet of dollar trades.

Dexia Crédit Local’s $1.5bn September 2023 was the pick of the bunch, being the only trade to make it into the 8s with an 8.05 overall. The deal scored particularly highly for structure/maturity, with 8.50.