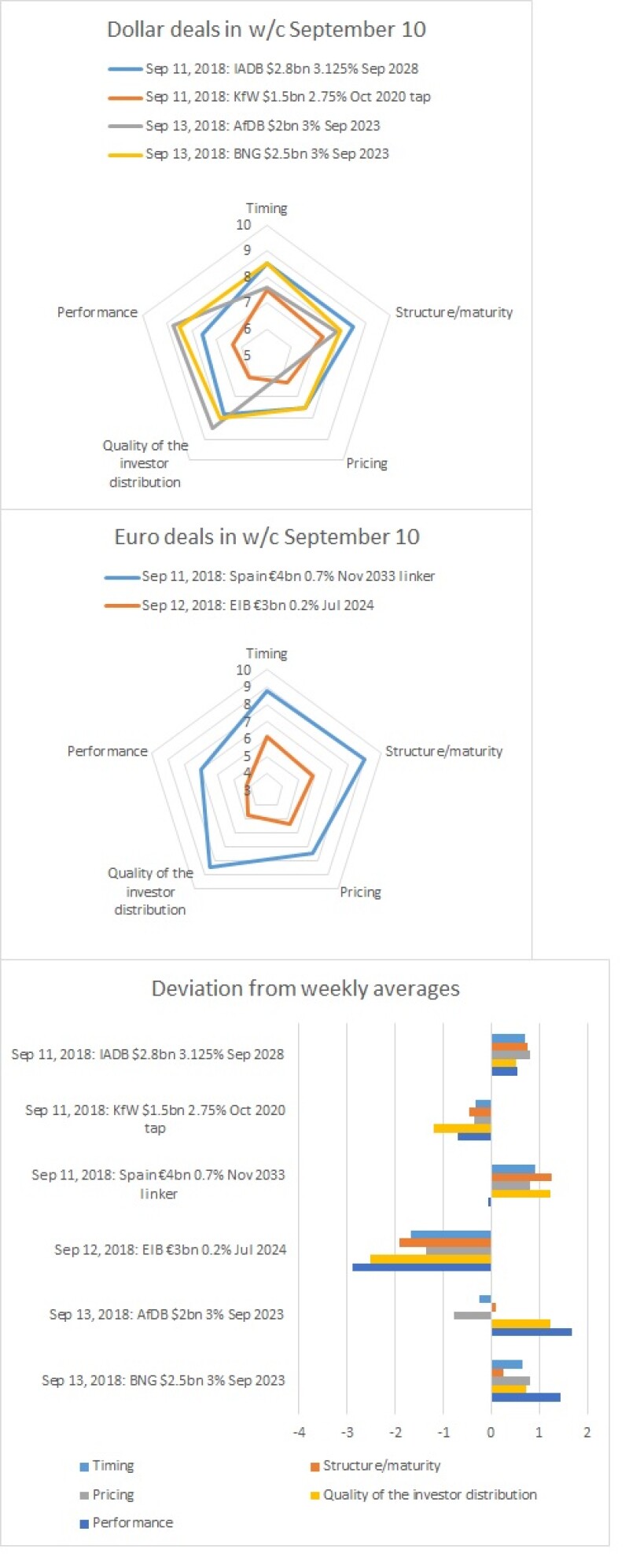

European Investment Bank’s €3bn July 2024 Earn, priced on September 12, received an average score of just 5.25. Only in timing did it score above 6.0.

Bankers that week reported that the dollar market was showing far better execution than euros, and the BondMarker scores adhered to that view, with most deals in the currency scoring overall averages in the high 7s to low 8s.

The only outlier was KfW’s $1.5bn tap of its October 2020, which scored an overall average of just 6.72.

There was one bright spot in euros that week, however. Spain’s €4bn November 2033 inflation linker took an average score of 8.15. Voters particularly praised the deal for its timing (8.75) and structure/maturity (9.00).

You can score last week’s benchmarks — euro deals from Cyprus, Joint Laender and KfW, and dollar trades by CPPIB Capital, Dexia Crédit Local, JFM and World Bank — by clicking here.