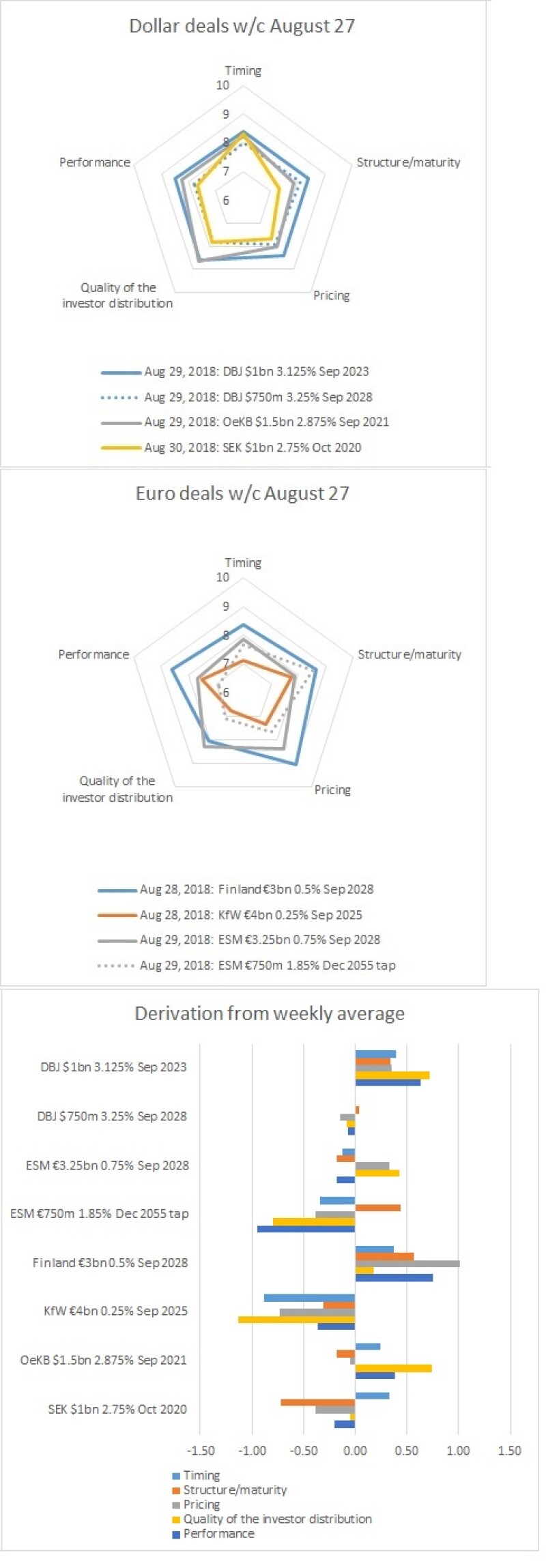

Finland raised €3bn in the week commencing August 27, but it was the pricing of 28bp through mid-swaps that particularly impressed BondMarker voters. The trade scored an average of 9.06 in that category — the only 9-plus score of the week.

Strong scores elsewhere took the overall average for Finland’s deal to 8.55, but it was not the only trade to score an average in the 8s area. Development Bank of Japan’s $1bn September 2023 — part of a dual tranche offering — scored an average of 8.46, while Oesterreichische Kontrollbank’s $1.5bn September 2021, which reopened the dollar market for core SSAs, scored 8.20. In euros, the European Stability Mechanism’s €3.25bn September 2028 — again part of a dual tranche trade — scored 8.03.

The rest of this week’s deals also performed well, with every one of those scoring in the 7s area.

There was only one benchmark last week, the European Investment Bank’s $3bn December 2021 global. That trade is available to score on BondMarker until 6pm on Thursday.

Have your say by clicking here.