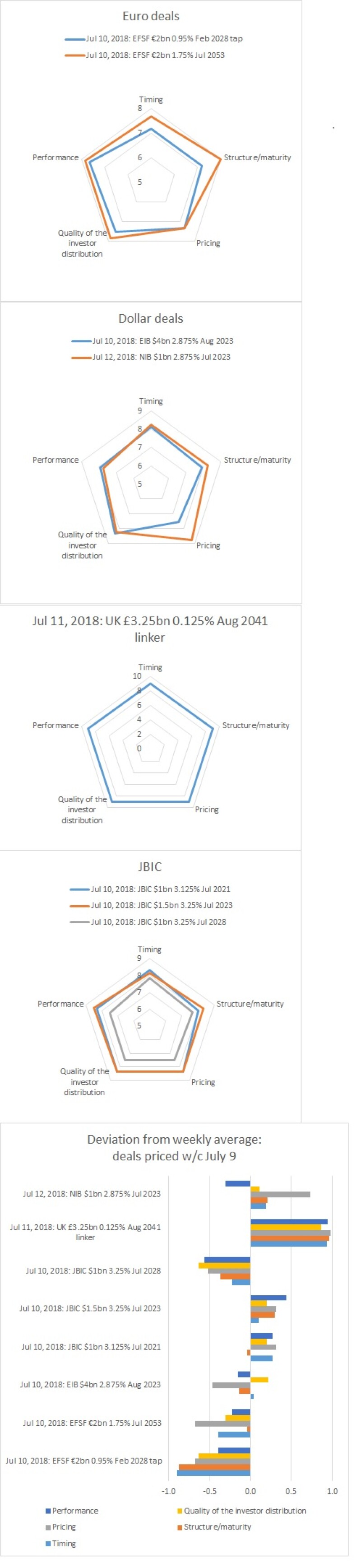

The UK scored an average of 9.00 in each of the five BondMarker categories for its £3.25bn August 2041 index-linker, taking it to the top spot for the week commencing July 9.

But there was also a strong showing for Nordic Investment Bank’s $1bn July 2023, which drew an average score of 8.25, European Investment Bank’s $4bn August 2023, which took an average of 7.96, and a triple trancher from Japan Bank for International Cooperation, whose legs scored a range of 7.60 to 8.33.

Reflecting what was a strong week for issuance overall, the week’s only euro benchmark — a double tranche trade from the European Financial Stability Facility — also performed well. Its €2bn February 2028 tap scored an average of 7.37, while its new €2bn July 2053 did even better with an average score of 7.73.