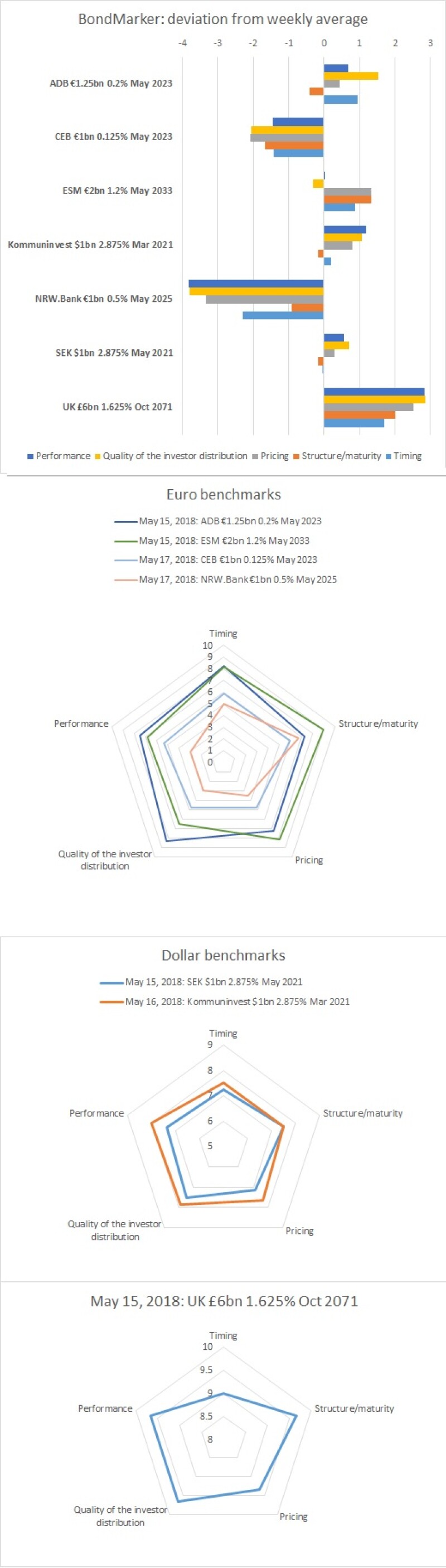

The UK’s deal, a £6bn October 2071 led by Barclays, Deutsche Bank, Goldman Sachs and NatWest Markets, won a near perfect average score of 9.47. It scored particularly highly for structure/maturity, quality of investor distribution and performance, with 9.67 on each.

The deal set two records for a UK syndication — number of investors (148) and nominal book (£37.8bn). But it was the execution that on-looking bankers commented most on.

“It was a smooth process, I could see that from watching the movement in underlying Gilts into and around the pricing,” said one banker at the time.

At the other end of the scoring charts in the week commencing May 14 came Council of Europe Development Bank, which scored an average 5.35 for a €1bn May 2023, and NRW.Bank’s €1bn May 2025, which only garnered an average 4.25.

Bankers on the deals blamed market conditions for the undersubscription on both, although those away from the trades felt that they had been priced too tight. That was reflected in the BondMarker scores. CEB received 5.88 and 6.00 for timing and structure/maturity, respectively, and NRW.Bank scored 5.00 and 6.75 on those two categories, all fairly average scores.

But CEB only scored 4.75 for pricing, while NRW.Bank received just 3.50.

There was little to separate the average scores of the week’s other deals, which received a range of 7.35 to 7.73.

But while most of those deals were fairly consistent across all categories, the European Stability Mechanism’s €2bn 1.2% May 2033 was notable in scoring very highly for timing (8.17), structure/maturity (9.00) and pricing (8.17), but fairly low on quality of the investor distribution (6.50) and performance (6.83).

All this year’s average BondMarker scores are available on GlobalCapital’s SSAs Priced Deals Database, along with all the SSA Bond Comments.