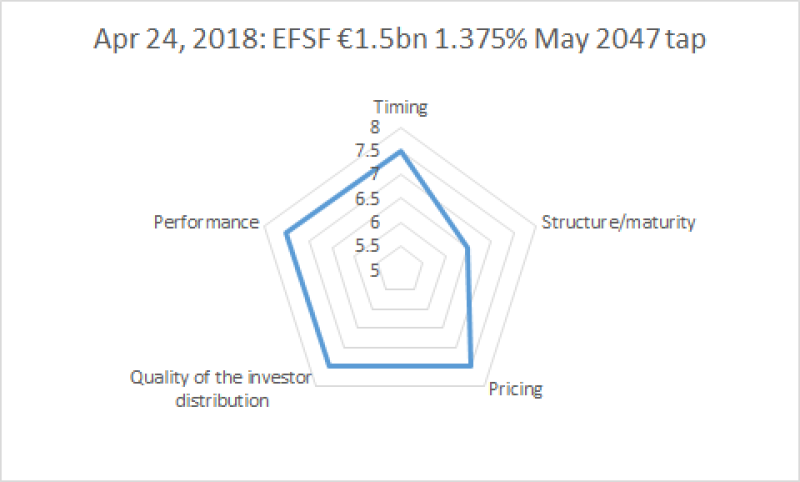

EFSF was joined by a pair of dollar trades from Kommunalbanken and KfW. The sole euro deal — a €1.5bn tap of EFSF’s May 2047 line — received an overall score of 7.3. Its average was let down only by its 6.5 score for structure/maturity. The deal, though it received strong demand and performed in the secondary market, received some criticism for adjusting the size from €1bn to €1.5bn during the execution.

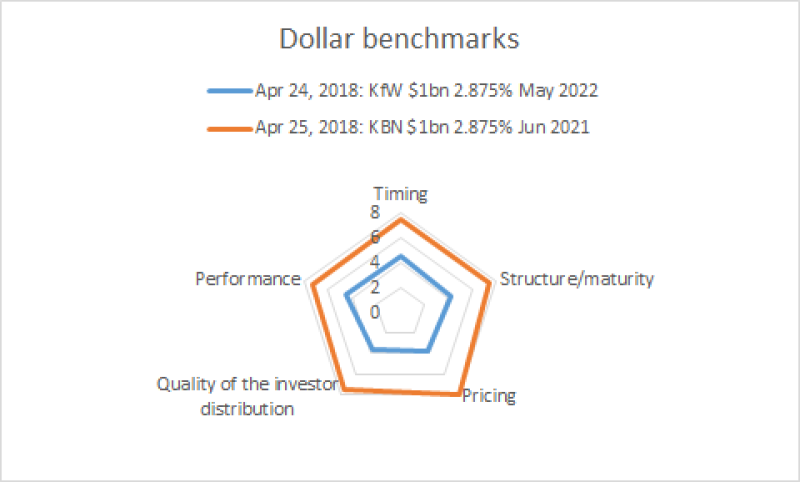

The dollar deals were, in some respects, remarkably similar. Both raised $1bn and came with 2.875% coupons. However, KfW’s four year was not so well-received by the BondMarker voters as the three year from Kommunalbanken.

KBN’s average of 7.55 was the best of the week. Its top category score was an 8, which it received for pricing, reflecting the praise the deal received at the time.

KfW’s deal — an aggressively priced off-benchmark four year bond — received an average score of 4.125. It scored 4.5 for timing and performance but only 3.625 for investor distribution.