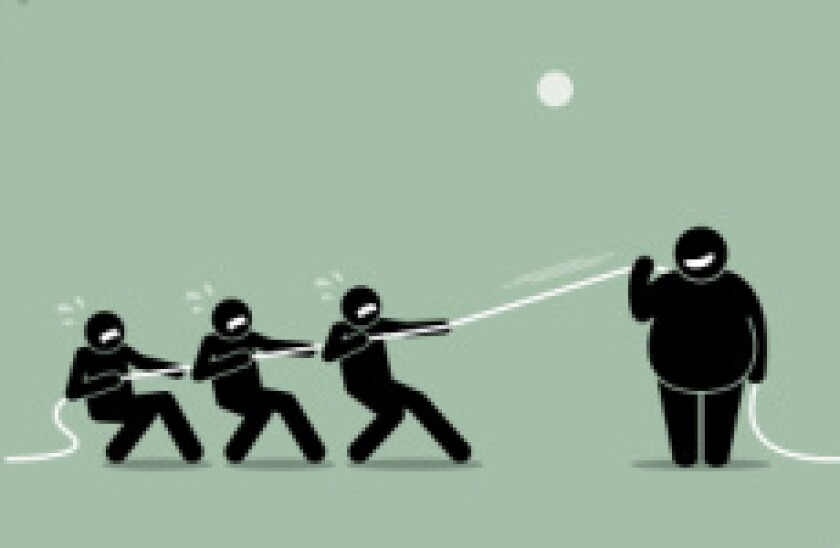

Recent history suggests that bankers trying to stop the deluge will probably have just as much success in stemming the change as they would in trying to hold back a flood.

Loans bankers voiced their dismay last week at the rise of emerging market borrowers looking to amend and extend (A&E) existing facilities, rather than go through a full refinancing process.

A&Es are a mainstay of the investment grade loan market, but are infrequent among the emerging market crowd. Given that borrowers do not usually pay fees to their banks for A&Es, it’s easy to see why lenders are not particularly keen on the development.

Even worse, according to loans bankers at least, is the growing prevalence of borrowers in the Middle East asking to replicate a maturity structure commonly found in investment grade — a five year loan with two one year extension options.

If A&Es were a few trickles of water breaking through the dam separating EM and IG lending terms, the emergence of five plus one plus one requests is a small but steady stream of water running down the dam walls.

The other reason lenders dislike the attempts is because, by their reckoning, conditions are fundamentally different for emerging market borrowers from those that apply to their IG counterparts.

It’s easy to see their worries. More EM loans get drawn, and companies at the lower levels of the spectrum are more liable to get downgraded or face financial difficulties. Meanwhile, there isn’t enough capital markets activity from many EM borrowers to offset the cost of making loans on loss-leading terms.

However, recent history tells us that all it will take is for a few banks to roll over and agree to these terms before the conditions EM borrowers are attempting to secure now go from being a fringe worry to the mainstream methodology.

Considering how dry pipelines are in the CEEMEA region, banks are going to be vying as hard as ever for business — and it will require impressive discipline to resist and pass on these deals.

One just has to look at the leveraged finance market. Covenant-lite loans have been around for many years but have recently come to dominate supply in Europe, as the strongest junk-rated companies can command loans with minimal covenants.

As the structure became more common, bankers complained. Without covenants, they said, lenders would be on the hook for all sorts of repayment problems, especially as the loans would be drawn. The reason investment grade companies get covenant-free loans is because their high ratings mean they are financially stable and will remain so.

Sound familiar?

But despite the griping, supply and demand gave bankers and investors little option. Accept the new state of the world, or miss out on deals.

All it will take is for one bank or group of mandated lead arrangers to green-light an EM deal with investment grade terms and then the famously competitive borrowers in the Middle East and Turkey will insist that they get funding at the same terms as their peers.

Trying to stop the flood once that leak has sprung will be all but impossible.