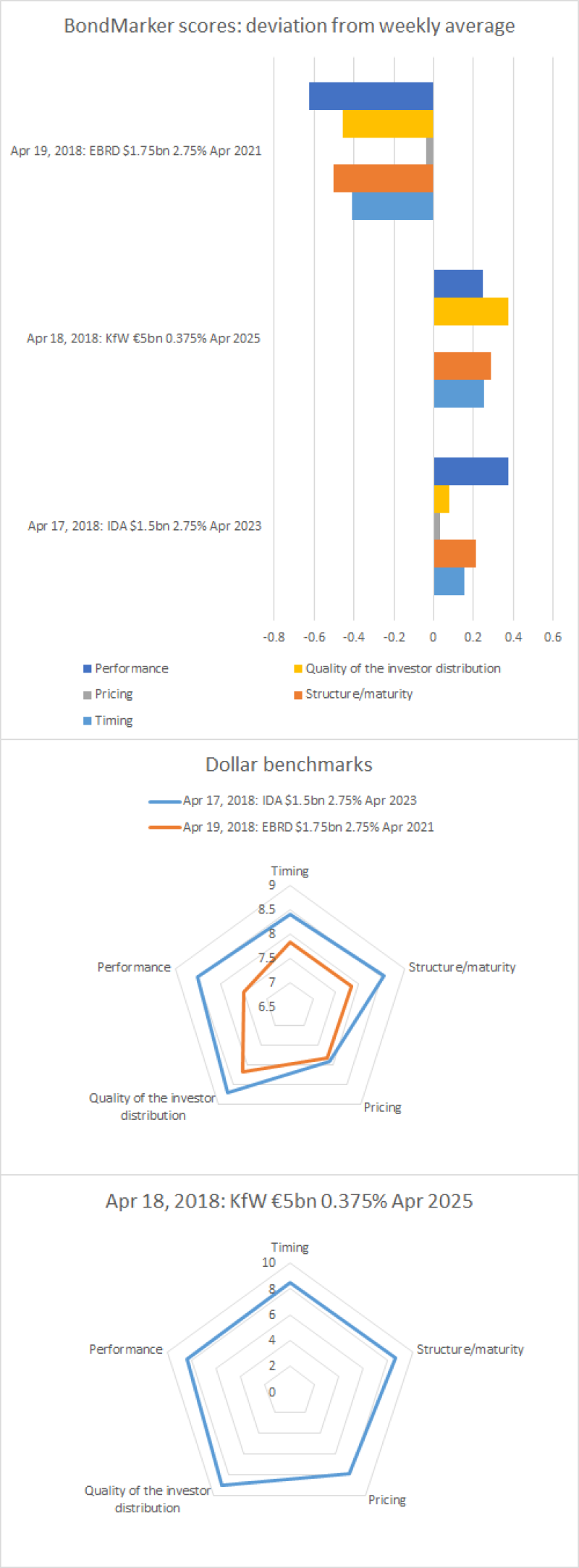

IDA’s $1.5bn debut — a five year which was led by Barclays, BNP Paribas, JP Morgan and Nomura on April 17 — was awarded an average score of 8.41. Its highest scores were in the quality of the investor distribution category (8.7) and in structure/maturity (8.55).

The deal attracted an order book of $4.6bn and was priced in line with sister issuer the World Bank’s curve.

“They should be over the moon with that — it’s a really strong print,” said a banker, who was not on the mandate, of the deal at the time of pricing.

But IDA was not quite the top scorer of the week. It was pipped to the post by a €5bn seven year from KfW that had a record breaking book for a KfW deal of €12bn — the second time this year the issuer has broken its own record.

That deal had an average score of 8.48. That deal also had its highest scores in the quality of the investor distribution category, where it scored a 9, and the structure/maturity category, where it scored 8.63.

JP Morgan, LBBW and NatWest Markets executed KFW’s deal on April 18.

European Bank for Reconstruction and Development rounded off the scores this week, with a $1.75bn three year that had an average score of 7.83. Its highest marks were in the quality of the investor distribution category.