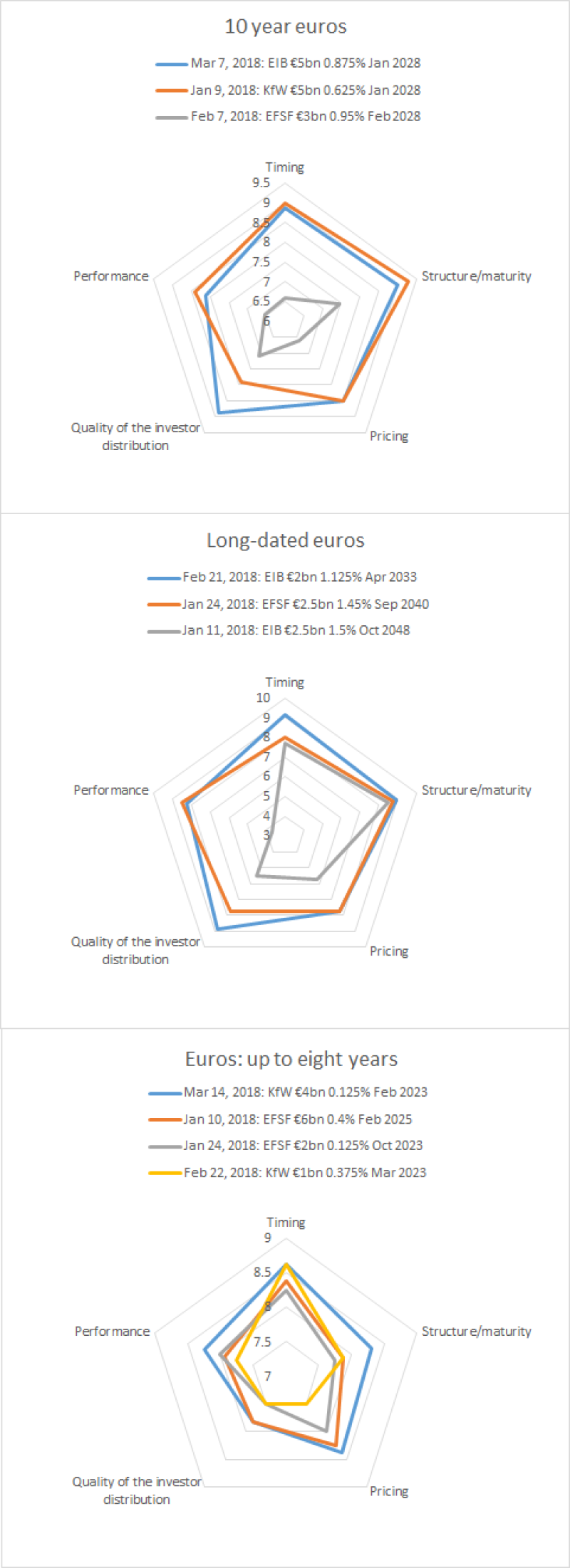

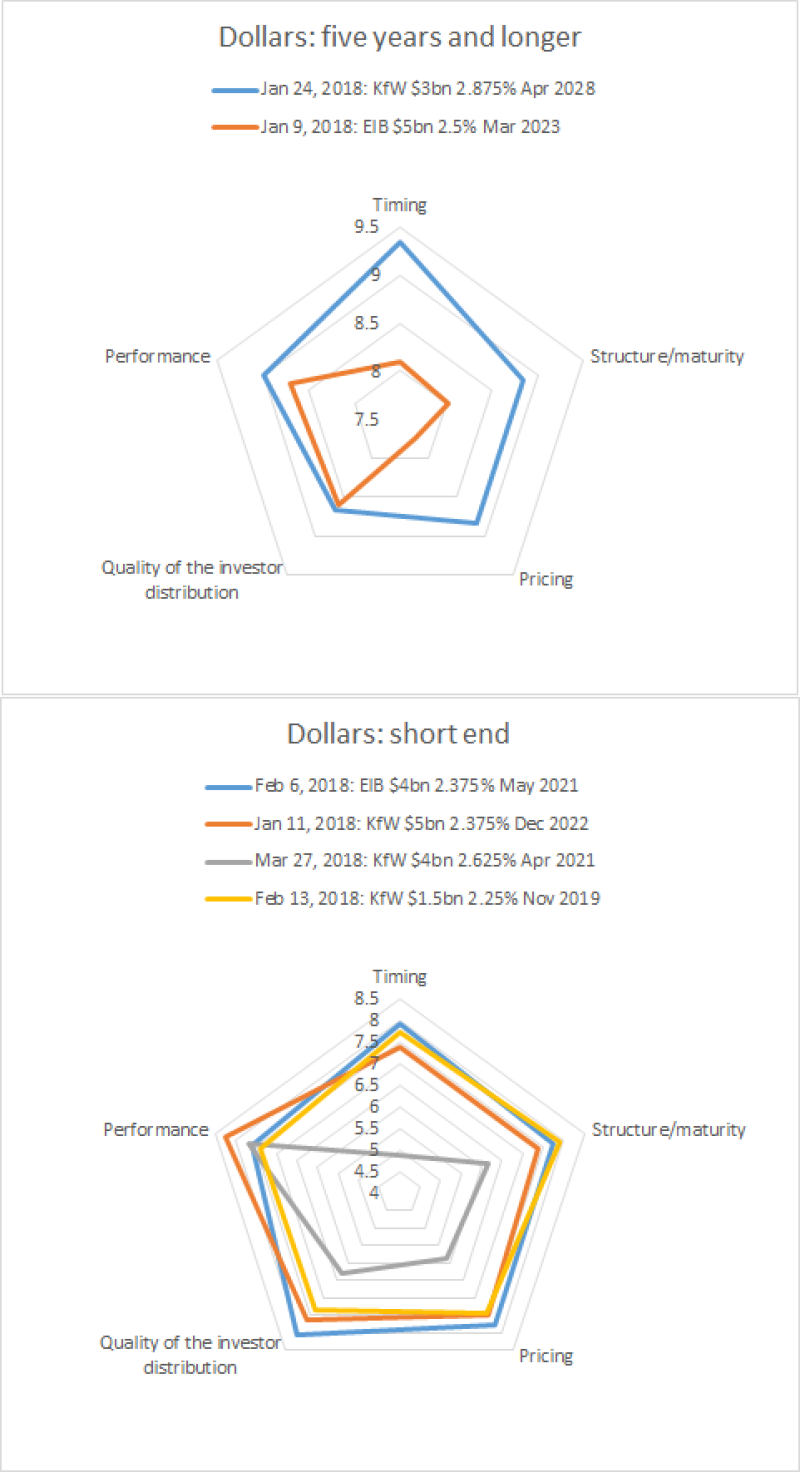

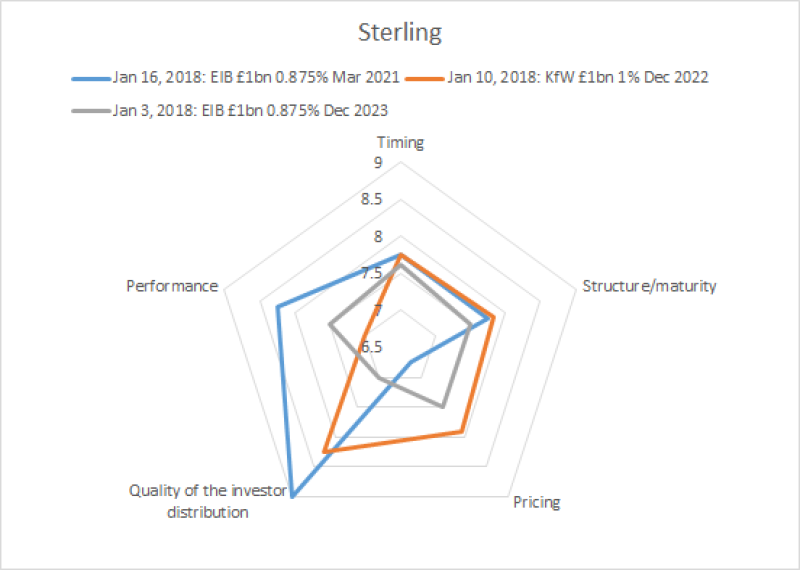

We highlight the scores of European Financial Stability Facility, European Investment Bank and KfW. Between them, they had 19 deals with BondMarker scores printed January-March 2018.

In euros, two of the highest scoring deals were €5bn 10 years, printed two months apart. EIB’s €5bn 0.875% Jan 2028, which was printed in March, had an average score across the five categories available for scoring (timing, pricing, structure/maturity, quality of the investor distribution, performance) of 8.675.

KfW’s 0.625% January 2028, which was priced in March, is hot on EIB’s heels with an average score of 8.62. A €3bn effort in the same tenor from EFSF in February — with a 0.95% coupon — shows how much fortunes in that part of the curve varied in the first quarter, clocking up just 6.86 points on average.

In dollars, long dated prints attracted the strongest reception on BondMarker. The only two deals in our selection to achieve an average score north of 8 were a $3bn 10 year from KfW, which was priced in January and was awarded a score of 8.93, and a five year from EIB that hit 8.24. KfW’s print was one of the highest scoring deals of any issuer in the quarter, the highest scoring dollar deal, and the highest scoring agency deal.

The most successful sterling print of our selection was a £1bn 0.875% March 2021 from European Investment Bank — that was awarded an average score of 7.9.

See below for charts showing scores of all 19 deals.