That’s why the news that three US banks are now working on a new platform to ease bond issuance pain points — sending out deal updates, pricing info and collecting investor interest and orders — is controversial.

Such a system already exists and has been adopted by at least 32 banks, though it is used predominantly for EMEA bond issues. Ipreo trialled its Investor Access system throughout 2016, going live early in 2017. Unlike the US bank proposal, it complies with the rules and is ready to use today.

Many investors don't use it but some do, from small accounts that struggle for attention to large accounts whose dedicated execution traders prefer it to a flurry of Bloomberg messages. New regulations from MAR to MiFID have increased the bureaucracy of bond underwriting and given an extra push to any system that makes it easier.

But US firms, in particular, along with many other big bond houses, have been reluctant to climb aboard.

One of the US houses launching the new system argued Ipreo must do better at integrating with investor order management systems — but this smacks of justification after the fact. Bank of America Merrill Lynch, Citi and JP Morgan have had years to raise these concerns.

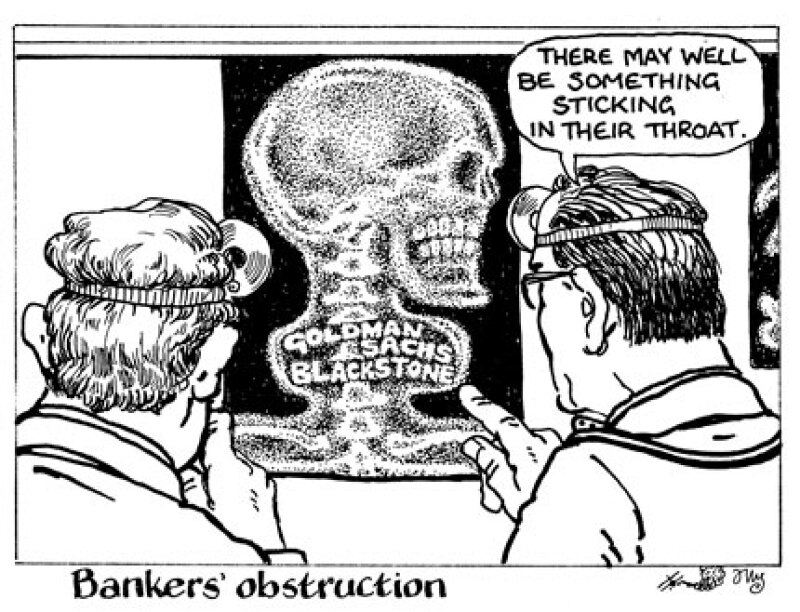

A far bigger issue is Ipreo's ownership. Goldman Sachs and Blackstone are not noted for their modest return targets. Some banks are reluctant to pay a competitor handsomely to handle their own relationships with the buy-side and create a platform that can corner the market.

It’s not a good thing to have competing standards duking it out for attention and market share. Investors don’t want more complexity in their workflow — quite the opposite.

But neither is it ideal to have a monopoly provider adding cost to the DCM business. A market-owned Ipreo would be the best solution, but an unproductive split in the market seems more likely.