A little unusually these days, the Schuldschein innovation does not involve blockchain. Refreshingly, Helaba is using a conventional online platform for its effort to cut the cost of Schuldschein issuance by 40%.

The scheme is no less interesting or radical for that. Helaba thinks centralising the whole process on a multi-dealer system could make the market faster, simpler and more efficient. Great for small issuers in particular.

Meanwhile, Marex Spectron, the London commodities broker, has issued two month structured notes on the Ethereum blockchain, using Nivaura technology. A parallel issue, conventionally settled, is meant to demonstrate the blockchain route is cheaper and faster.

Marex did not use a bank at all. If Helaba’s omniperfect system gets going, will Schuldschein issuers need banks to find investors — who will all be logging in daily?

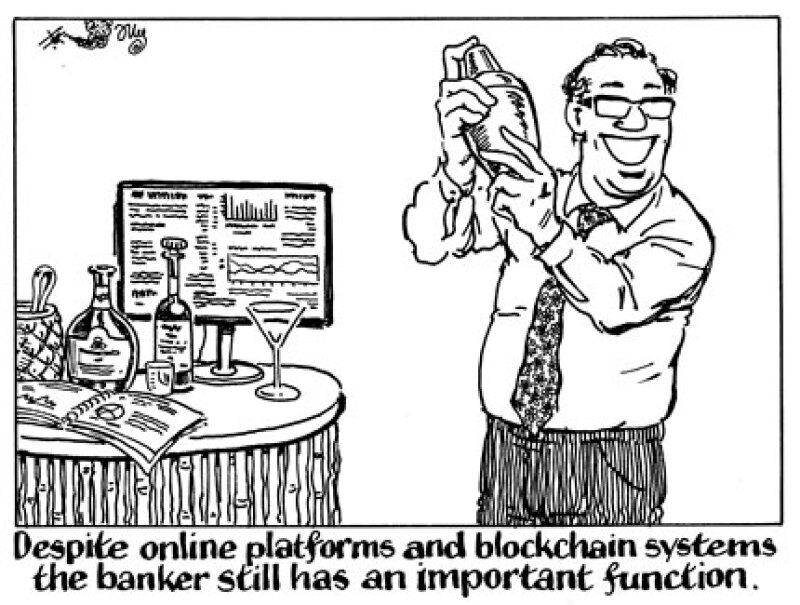

Tech certainly means dealers are no longer so crucial to connecting issuers and buyers.

That need not make them redundant. In the Schuldschein market, investors getting small tickets cannot afford the time to keep analysing new credits. They trust the banks to bring borrowers they know and trust of old. The banks provide research and the investors trust it.

Marex may not be a bank, but it is a futures broker. It has specialist skills at finding customers that want certain risk exposures, constructing those exposures with derivatives, and hedging the risk.

Banks and brokers may lose their edge as plumbers as tech takes over, but they are still needed for many higher value jobs in capital markets.