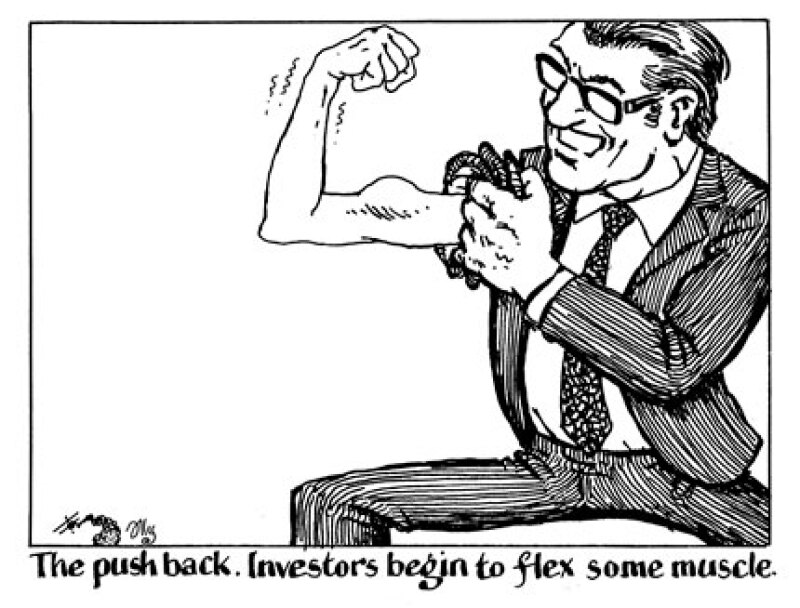

For the first time in months, covered bond buyers are holding out for the last basis point. It may not seem like much but it does suggest a distinct change from 2017 when they blithely accepted aggressive pricing tactics.

Issuers with size ambitions have still enjoyed exceptional pricing by historical standards but, in contrast to last year, some have been unable to tighten spreads by more than one iteration. And borrowers that have managed to tighten have had to accept smaller deals for the privilege.

DNB Boligkreditt did not believe that its €2.2bn order book, that was good at 10bp through mid-swaps, could support a €1.5bn trade at 11bp through. Canadian Imperial Bank of Commerce, which attracted €1.9bn orders at 4bp through mid-swaps, saw orders fall to €1.6bn at 5bp through.

NordLB opted to keep pricing at 8bp through so it could issue a €1bn trade, while Société Générale, which had a €1.5bn order book at 7bp through, printed a €750m trade at 9bp through.

In the government bond market, deals have started at more generous levels to ensure strong early order book momentum. But the rise in yields that took place over year-end may have masked investor dissent, helping to propel demand more than would have otherwise been the case.

As issuers go into blackout the drop in supply will offer a reprieve giving cause for comfort, or complacency. But don’t be fooled, the end game may be a way off but the balance has already tilted in favour of investors.