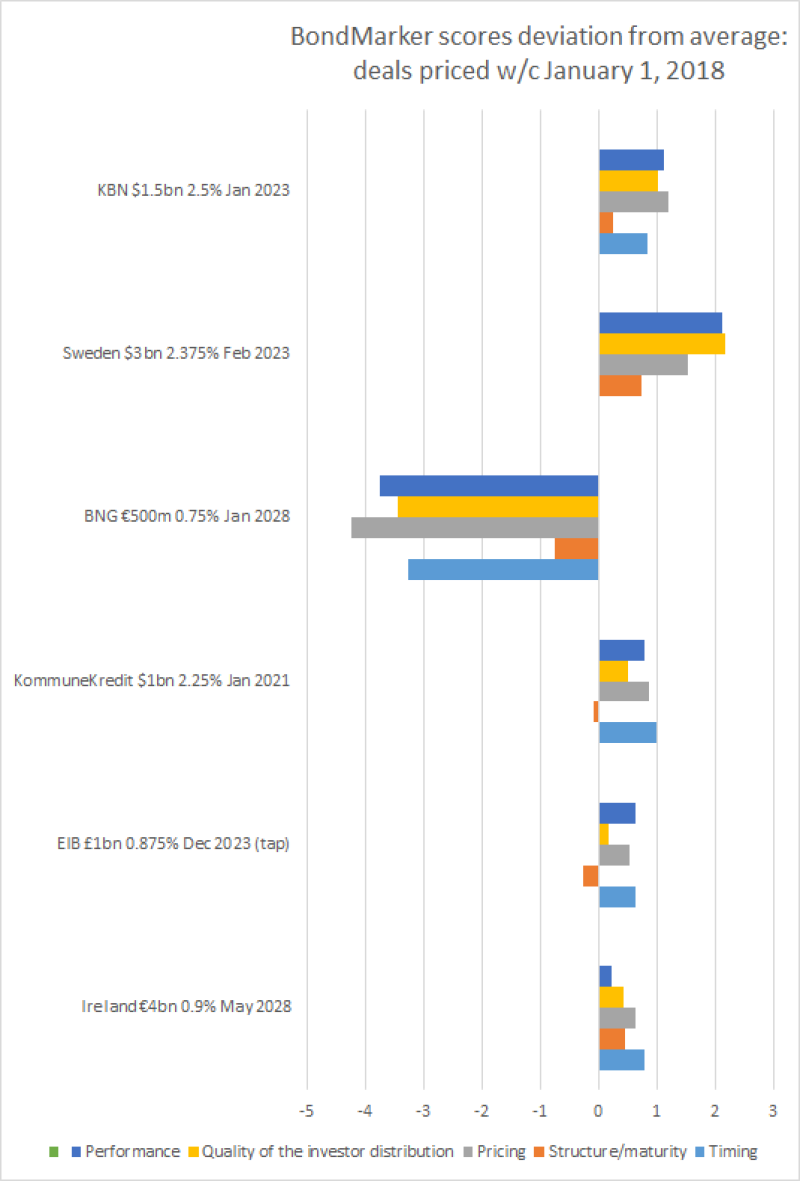

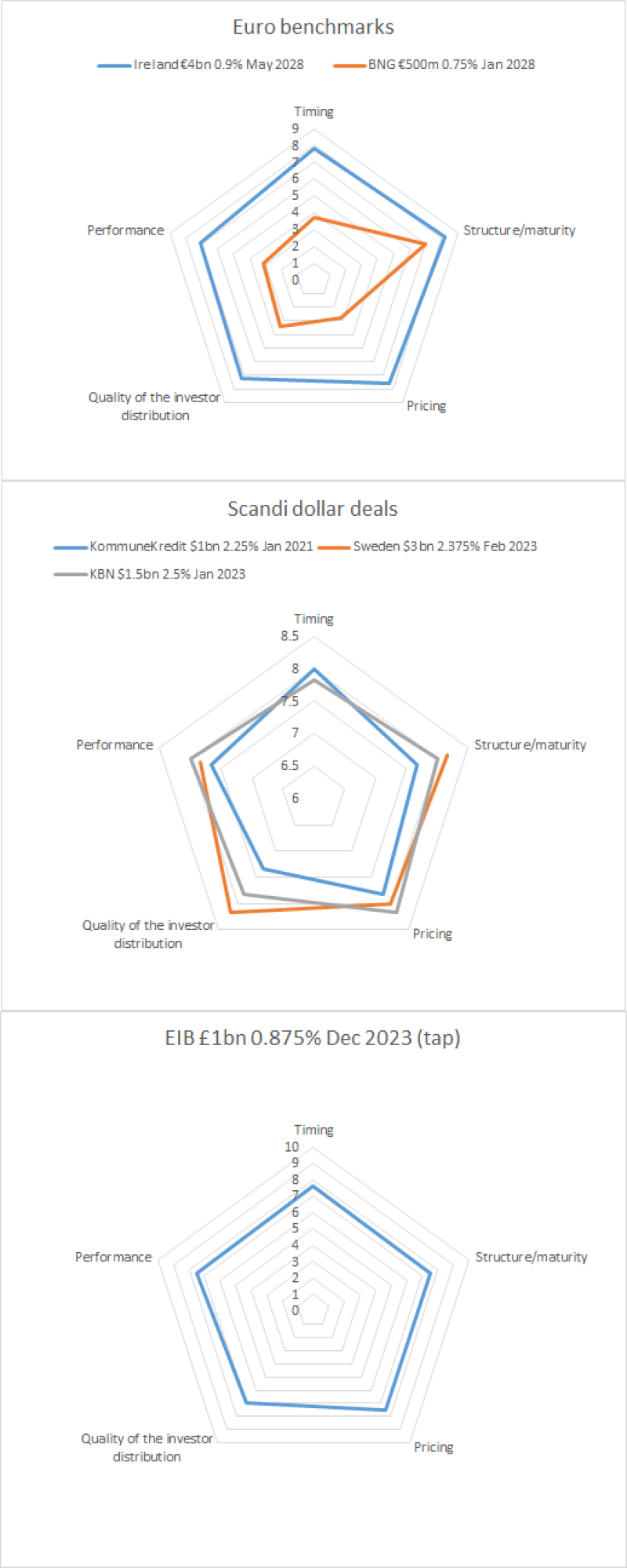

Ireland led the charge in euros, with a €4bn May 2028 that drew orders over €14bn. Our voters gave it an average score, across the five deal categories available for voting (timing, structure/maturity, pricing, quality of the investor distribution and performance) of 7.6. It attracted a particularly high average score of 8.2 in the structure/maturity category. It was led by Citi, Danske, Davy, JP Morgan, Morgan Stanley and Nomura.

The other euro print of the week — a €500m January 2028 from Bank Nederlandse Gemeenten that had to be cut from €1bn after failing to attract enough demand — fared less well with voters. The deal scored 4 on average, but in the structure/maturity category it achieved a decent 7. BNP Paribas, Citi, DZ Bank and JP Morgan were leads.

A trio of Scandinavian borrowers brought deals in dollars that were closely matched in the voting. Sweden just pipped the others to the post with a $3bn February 2023, led by BMO Capital Markets, Goldman Sachs, HSBC and Nordea, that achieved an average of just over 8 (across four categories).

Kommunalbanken and KommuneKredit scored just under 8 and 7.7 on average with their deals. KBN also plumped for a 2023 maturity and printed $1.5bn while KommuneKredit printed a $1bn three year.

Bank of America Merrill Lynch, JP Morgan, Nomura and RBC Capital Markets led KBN’s deal, while BMO Capital Markets, BNP Paribas, Daiwa Capital Markets and JP Morgan led KommuneKredit.

European Investment Bank tapped a 0.875% December 2023 line for £1bn through Deutsche Bank, HSBC, NatWest Markets and RBC Capital Markets. The deal notched up an average score of 7.4, with its highest scores in the timing category.