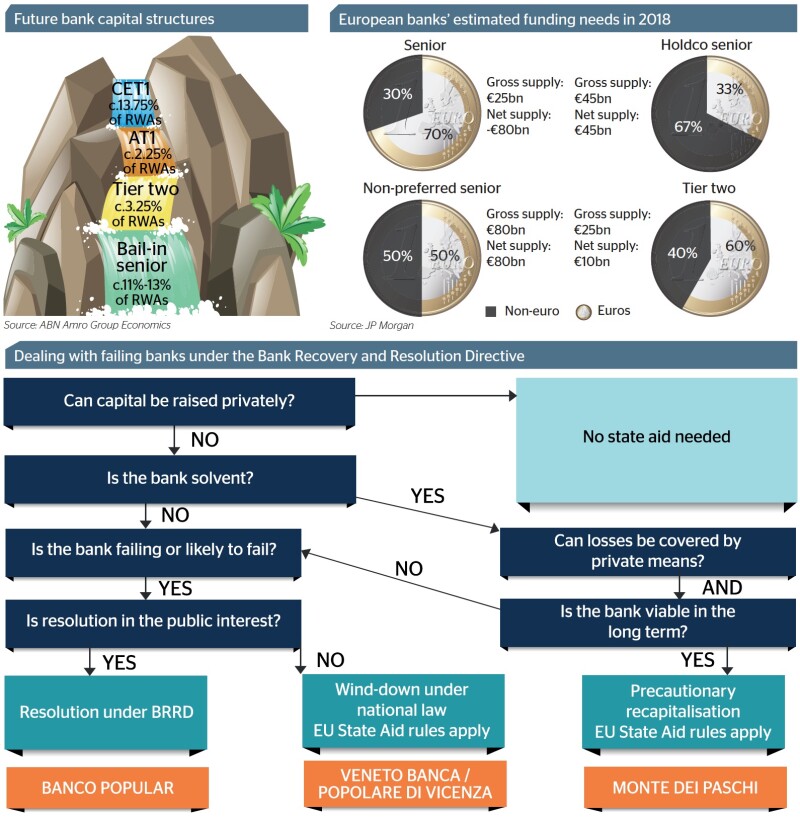

In 2018, every bank in Europe will for the first time be able to issue new forms of senior debt, specifically designed to be available for recapitalising a bank, should it run into trouble.

The largest firms should have little trouble transforming their funding mixes for the new world order, replacing ordinary senior unsecured instruments with bail-inable senior bonds by accessing investors in a range of currencies. Many of these investors were newly introduced to the ideas behind the Minimum Requirement for own funds and Eligible Liabilities (MREL) last year.

But attention is likely to turn once again to some of Europe’s smaller financial institutions. Market participants saw the European bank resolution regime tested for the first time in 2017. But 2018 is likely to bring further events when the Bank Recovery and Resolution Directive (BRRD) is called upon by the regulators.