The long end of the dollar curve is a case in point. Several issuers have brought exceptionally strong 10 year trades over the last few weeks, after just a handful earlier in the year.

While that might mean borrowers can feel confident about tapping 10 year dollars in the new year, that was the exact same situation at the end of 2016 — but issuance was sparse in the early part of 2017.

The last 12 months or so have taught us that shocks can come from the most unexpected of areas. Everyone was terrified about the potential outcome of the French presidential election earlier this year, but the result was to everyone’s liking. By contrast, the German federal election in September looked to be something that should only concern citizens of that country, but we’re in November and a new coalition government has yet to be formed.

In short, windows can close quickly and those borrowers that act nimbly and flexibly will reap the greatest rewards.

Rentenbank did just that this week. Knowing that there had been a correction at the dollar short end last week, the German agency took the brave choice of bringing a 10 year dollar trade and was richly rewarded. That was likely in part because it has taken those 10 year chances when they’ve been available in the past — creating a strong investor base for the next visit.

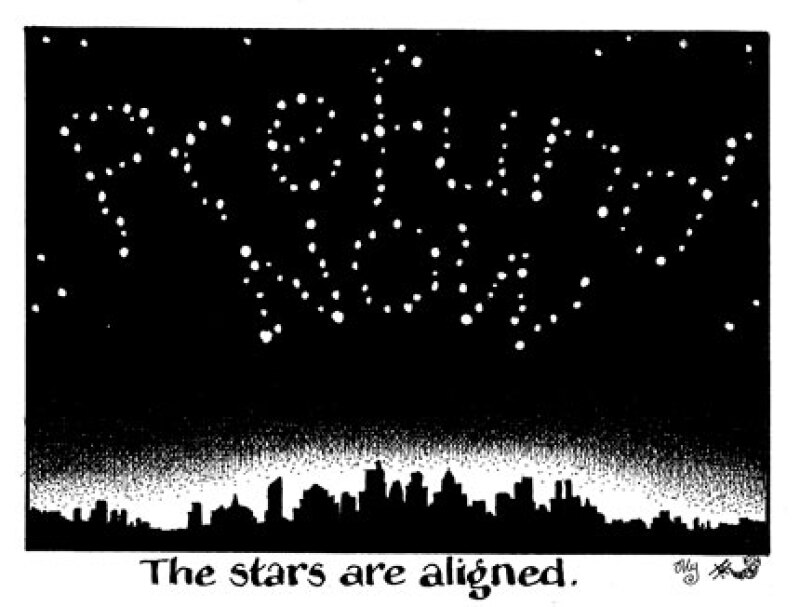

In an uncertain world, flexibility is key — perhaps also so on prefunding .