The reaction to Catalonia’s independence referendum in bond markets has been all but non-existent — a slight move in Bonos, brushed off when Catalan president Carles Puigdemont stopped short of an unambiguous declaration of independence.

Market participants seem perfectly satisfied that, while the consequences of Catalonian independence would be terrible, the risks touch only the Spanish economy, and that, in any case, further deterioration of the situation is unlikely.

Their confidence could be misplaced. First, while Puigdemont offered to negotiate with Spain’s prime minister, Mariano Rajoy, their positions remain diametrically opposed. Catalan’s nationalists insist on independence. Spain rules it out. Neither is ready to compromise.

Second, while Puigdemont may come under pressure to relent from businesses and European officials, his own parliament and political base will urge him to stay the course. Important voices in Catalonia are calling for unity, but the UK’s vote for Brexit shows how easily such warnings can be ignored.

Next week, it looks like Puigdemont will stand his ground, and Rajoy is willing to take control of the Catalan government. What then? We have already had a taste of what it looks like when Spain asserts its control over Catalonia. At the very least, expect strikes and unrest. And no exit from this impasse is apparent.

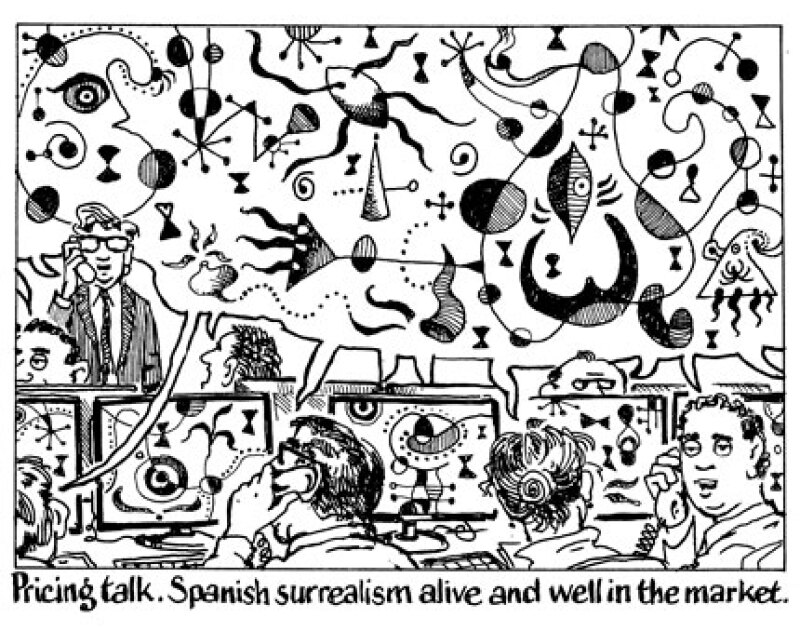

Investors have another reason for shrugging. They are blithely confident that if markets turn ugly, central banks will ride to the rescue. This is surely the worst example yet of easy money having dulled investors’ wits and made them indifferent to risk.