Ask anyone in the European sovereign, supranational and agency bond market about which upcoming regulation is most on their minds and the answer is inevitably the update to the Markets in Financial Instruments Directive (MiFID II).

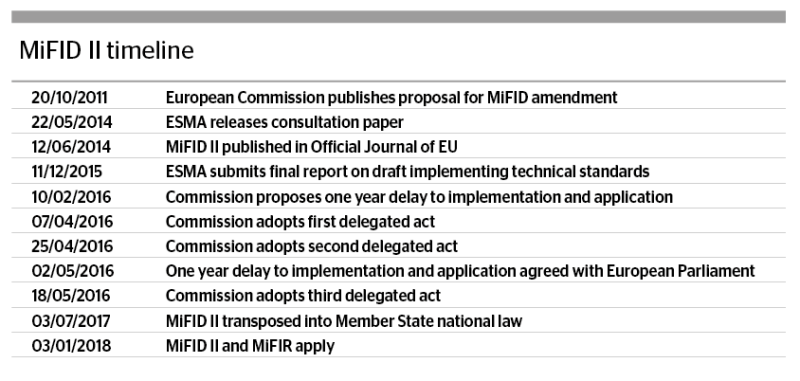

Due to come into effect at the start of 2018 after some delay (see timeline), MiFID II aims to make markets more transparent and investor friendly by shifting trading to regulated platforms or increasing transparency for trades that stay over the counter (OTC).

“We’re not an investment firm so MiFID II won’t affect us directly, but of course we issue bonds and we also invest in bonds, and we use derivatives for hedging purposes, so there is a large array of financial instruments we trade in,” says Jochen Leubner, head of capital markets, law and regulation at KfW in Frankfurt. “We may be indirectly affected by MiFID II in terms of the potential impact of the new requirements on market structures and the behaviour of participants. The extent of the significant changes that occur is still to be seen.”

Banks are beavering away to make sure they comply with MiFID II when it comes into force, but when issuers speak to banks to find out how it may affect the sell-side, they do not always find consistency in terms of understanding, according to Leubner’s colleague at KfW, head of capital markets Petra Wehlert.

“We’re hearing from banks that this is one of the biggest topics they’re covering for next year — and there are different levels of knowledge, depending on which institution you talk to,” she says.

Market conditions for issuers and banks are “very good” she adds, creating “a very good framework for the new regulation to kick in”. But with potential threats on the horizon — from North Korea’s belligerence to a still uncertain political outlook in Europe — there could still be a market weakening before MiFID II comes into force.

“We’ll see how it develops if markets become much more volatile — that will be the real test,” says Wehlert.

One area where MiFID II could affect SSA issuance is in the new pre- and post-trade transparency requirements for bonds.

“This may affect the liquidity of our bonds and thus our international investors — mainly institutional investors — because most secondary market flow is traded in the OTC market, rather than on fully transparent electronic systems,” says Wehlert. “We monitor the situation on waivers and exemptions, but we also asked banks how they have positioned themselves for next year, because liquidity in KfW bonds is important for our investors and for us to receive good pricing indications for primary issues.”

But the potential impact on liquidity is already causing concern for some on the buy-side.

“When we speak to investors, their main regulation worries seem to be around liquidity and what sort of assets they can buy,” says Anish Gupta, head of treasury at Oesterreichische Kontrollbank, an Austrian agency issuer in Vienna.

Those banks that are directly affected by MiFID II are “heavily engaged” in preparing for the regulation, says KfW’s Leubner.

“There are huge IT projects and other implementations work to be done, so they are very much busy in that area,” he adds. “The discussion among banks and their clients on the market impact of MiFID II is really just starting, from our point of view.”

While those costs and work may be higher in size at the banks, the work can also be onerous for some issuers in the SSA market — particularly those with a smaller headcount.

“For a small organisation such as ourselves, it’s a lot of work to tape all the Bloomberg chats, the emails, the telephones and the mobiles,” says Bart van Dooren, head of capital markets and investor relations at Bank Nederlandse Gemeenten in The Hague. “We have a working group here for MiFID implementation.”

How to allocate

MiFID could affect bond issuance in other ways. The regulation seeks to ensure fairness and transparency when allocating bonds from an oversubscribed book, meaning issuers will probably have to justify why, say, a central bank takes home more paper than a hedge fund.

That could have a particular effect on the small but fast growing green bond market, where issuers are often keen to ensure that investors with strong socially responsible investing credentials take home a healthy portion of paper.

“MiFID requires us to be clear how we want to allocate and be transparent about that,” says Arnold Fohler, head of DCM at DZ Bank in Frankfurt, speaking at the GlobalCapital Sustainable and Responsible Capital Markets Forum in Amsterdam in September. “Thus, we might face a situation where we need to justify ourselves.

“Assume a book that is heavily oversubscribed. Issuers and banks decide to focus on dark green investors first. So we need to come up with a definition of who is ultimately how green. Because other investors might ask, ‘why did I get a zero allotment? I consider myself green’. Or we might have a book that is not heavily oversubscribed, so we might be forced to allocate bonds to investors that are not green at all, but are needed to bring the deal to the finish line.”

The question of allocation under MiFID is on SSA issuers’ radars, but they believe it should be less of a concern for them than for borrowers in other markets.

“This is a major element of the execution process in the future,” says KfW’s Wehlert. “We need to ensure with the banks that we have a proper process in place for next year to avoid any disruptions. I understand this topic is more focused on the corporate segment. However, banks have to cope with it in the SSA segment, too.

“KfW has already a very systematic approach. In the green bond market, for instance, we sell to both green and non-green investors, and I understand that if as an issuer you have a specific interest to allocate more bonds to green investors then that’s fine, as long as you have good reasons to do so and can explain why, and are willing to be recorded.

“We are pretty confident we can find a good solution here.”

Public sector borrowers may have less to worry about from the allocation aspect of MiFID II because of their typically lower levels of bond issue oversubscription, says a head of syndicate in London.

“SSAs will be able to manage the process, but it might take a bit longer,” he says. “Their volumes are so large. It’s not like a corporate deal that is 10 times oversubscribed or whatever.”

But some participants are concerned about the extra level of reporting that will probably be required.

“It may mean there’s some rigid interpretations between certain groups of investors,” says an SSA syndicate official in London. The issuers and banks should retain some flexibility when allocating trades. There are also different interpretations between banks. Having some clarity would be a bit more helpful.”

Being clear

That lack of clarity pops up in other areas. Sometimes there can be confusion over which issuers are covered by new regulations, owing to the variety of borrowers in the SSA market.

OeKB’s Gupta provides an example of how the exact make-up of his organisation puts it in a particular category: “Certain regulations don’t affect us because we’re explicitly guaranteed, but others do since we’re not owned by the sovereign. EMIR [European Market Infrastructure Regulation], for instance, is a relevant regulation for us in terms of reporting derivatives and clearing interest rate swaps.”

Another regulation — the Market Abuse Regulation (MAR), which came into effect in July 2016 and toughened rules on market soundings — also confused at first, say bankers.

“There was some uncertainty about what it meant and how it was to be implemented,” says another head of SSA syndicate in London. “Hopefully we won’t see the same with MiFID II.”

Now that MAR is in place and fully understood, there has been some impact on how the market has developed.

“MAR has become important in the SSA world,” says OeKB’s Gupta. “Since its introduction there has been less information flow before a transaction.”

Some other issuers say, off the record, that this has meant they have had to start initial price thoughts wider than before, because there is less information available.

This has not affected the larger, more frequent borrowers, however.

“At KfW we have a proper secondary market curve and a good view on markets,” says Wehlert. “We don’t need a lot of price discovery — we can take into account different criteria and by a basis point or two define the price for a new issue.

“MAR in terms of bond issuance mainly focuses on the market sounding process — if you need to do more of a market sounding to find a price for a new deal then you’re probably more affected, although I understand there is a safe harbour and you can do market soundings if you put in the documentation effort.”

She adds: “On the issuer side, we don’t disclose our concrete issuance plans too early — we are a regular issuer anyway — because as long as the banks don’t know what we want to do they can act completely independently, talk to investors and gather general, non-deal related feedback on investor preferences.”

But for some on the buy-side the new rule did prove onerous, according to her colleague Leubner.

“The intention of the rules — to provide a safe harbour from unlawful disclosure of inside information — was positive but it comes at a cost for market participants, namely increased documentation for both the sounding banks and the investors that are sounded, even where there no disclosure of inside information occurs in the process,” he says.

“I’ve heard from our investment colleagues, who are sounded from time to time, that the market took some time to set up the processes. But our view is that it has adapted to the changes.”