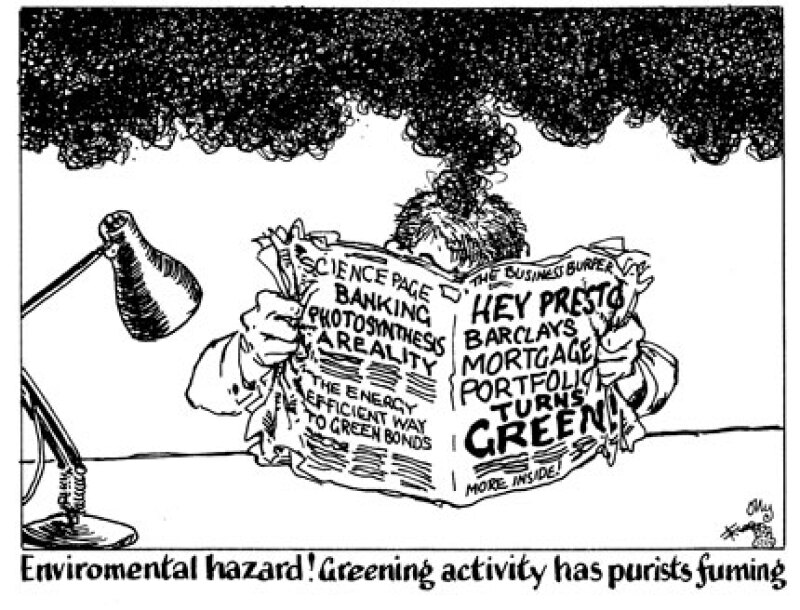

Thanks to the UK government’s release of detailed energy efficiency data on British houses, Barclays has been able to green its mortgage portfolio — not, you understand, to change its lending habits at all, but to see in precise detail how energy-efficient the homes securing its mortgages happen to be.

The UK bank will use this information to issue green bonds, linked to the 15% most energy-efficient mortgages. This data dump has therefore generated a “green portfolio” where none existed before.

Barclays is just following usual green bond practice. Most issuers, from supranationals downwards, start their socially responsible journey by collecting data and identifying green activities.

But if we want green bonds to fuel a move to lower carbon, they must fund new activity, not just rebadge existing loans.

Owners of green bonds backed by existing books can comfort themselves (or kid themselves — money is fungible in corporate treasuries) that they’re only funding clean activities, in this case the purchase of well insulated homes, while the world continues much as it was before.

Backing green bonds with green mortgages does not mean green homes will receive cheaper mortgage finance, nor that banks will starve planet-wrecking borrowers of lending.

Barclays has taken other well-meaning steps, such as using its liquidity buffer to buy green supranational bonds but it continues to offer financing to supply oil from tar sands. If it really wants to change the world, it should change its lending, not its liabilities.