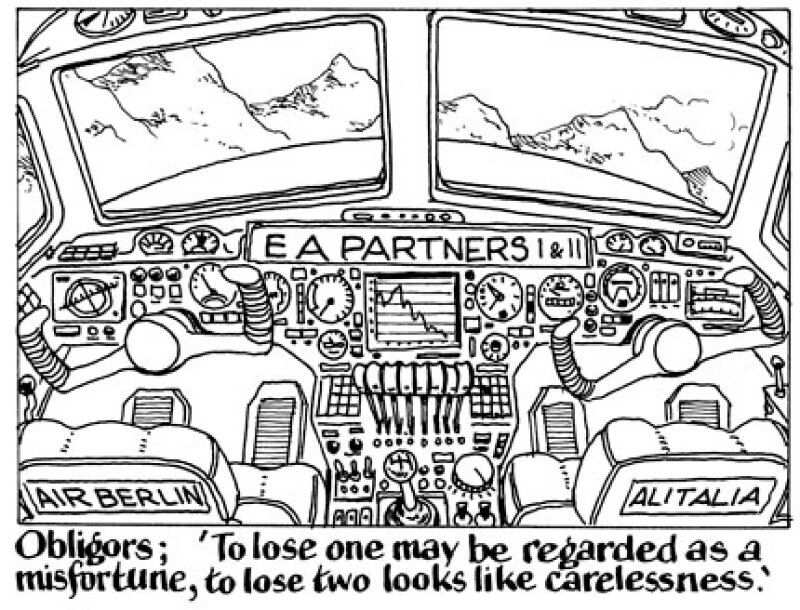

On Tuesday the $500m 2020s, and $500m 2021 structured bonds, issued by EA Partners I and II, dropped 12 cash points in the secondary market after Air Berlin became the second of the bonds' obligors to file for bankruptcy, after Alitalia.

While Etihad stepped in to support Alitalia’s portion of its obligation in the EA Partners structures, it is uncertain how it will deal with Air Berlin's, particularly as Etihad’s pulling of the funding plug on the struggling German airline led to its collapse in the first place.

The bonds are now languishing around 85 in the secondary market, suggesting that investors are as clueless now as they were when they bought them. That price is not low enough for a recovery process-inducing default verdict, nor high enough to imply confidence that Etihad or Abu Dhabi will support the structure.

Bankers at the time of issue were equally critical and praising of a deal described as “too clever by half” — it essentially allowed Etihad to support its partners without breaking laws that restrict cash injections to airlines.

In the meantime, did investors really do extensive credit work on Air Seychelles and Air Serbia? Or did they just buy because the bond was sold with a shiny Etihad branded wrapper?

What the sell-side agrees on is that investors didn’t know what they bought. Some played for yield, others for the Etihad name, but none for a love of the “crazy structure”.

In the end, bankers expect Etihad, or a related Abu Dhabi entity, to step in to save its brand by supporting the bonds, which perhaps means that investors will not learn the lesson they should — do not judge a bond by its wrapper.