The three year tenor in dollars is often considered the safe option: a willing investor base with deep pockets and less susceptibility to volatility in the swap or US Treasury curve than in longer dated, and less liquid, tenors.

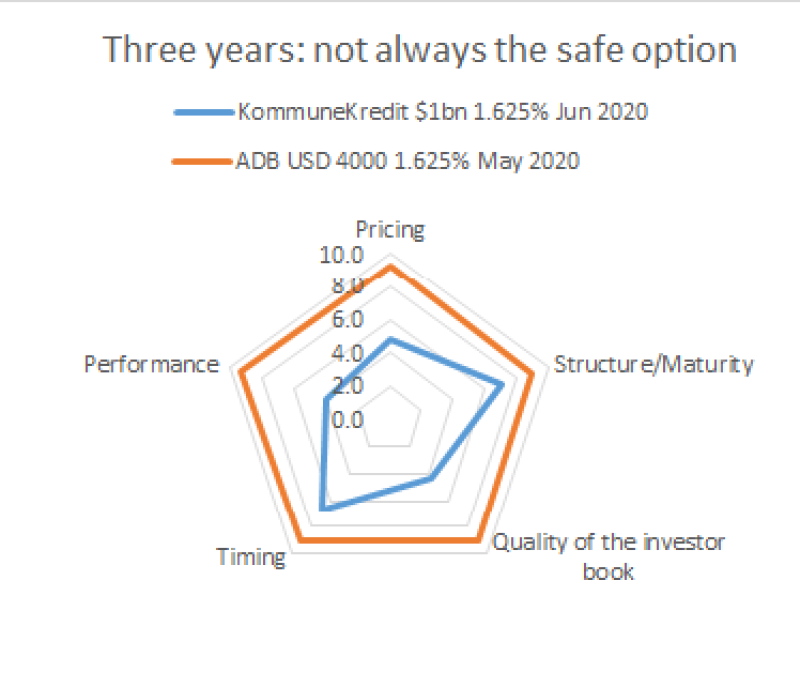

But BondMarker scores in the last quarter showed that not every three year is guaranteed to be a knock-out: the top scoring dollar deal of the quarter was a three year — but so was one of the lowest scorers.

Voters embraced a $4bn 1.625% May 2020 from Asian Development Bank that was priced on April 26 and led by BMO Capital Markets, Citi, Deutsche Bank and RBC Capital Markets.

The deal’s $4bn size was a record for the issuer and books grew to more than $5.4bn.

The deal tipped the scales at a weighted average of 9.1 over the five categories available for scoring on BondMarker (pricing, structure/maturity, quality of the investor book, timing and performance). That is just shy of the 9.3 average scored by the European Investment Bank with a long dated benchmark in euros.

“ADB has a significantly larger funding plan this year and this trade shows it has no problem doing larger deals,” said a banker away from the deal at the time of pricing. “Three year trades always go well, but ADB picked a good window with none of the big issuers looking and the market needing supply.”

BondMarker voters were particularly impressed with the deal’s pricing and performance.

A $1bn 1.625% June 2020 for KommuneKredit did not receive the same level of adulation, despite coming in the same tenor just over a month later. The deal, which was led by BNP Paribas, Goldman Sachs, JP Morgan and Nomura, was announced as a $1bn no-grow on June 1. However, there were no book updates during the execution process and the deal was printed in line with guidance at 5bp over mid-swaps.

Voters awarded low scores in the pricing, quality of investor book, and performance categories. But the deal achieved good marks in the structure/maturity and timing categories.

Click here to read more about GC BondMarker.