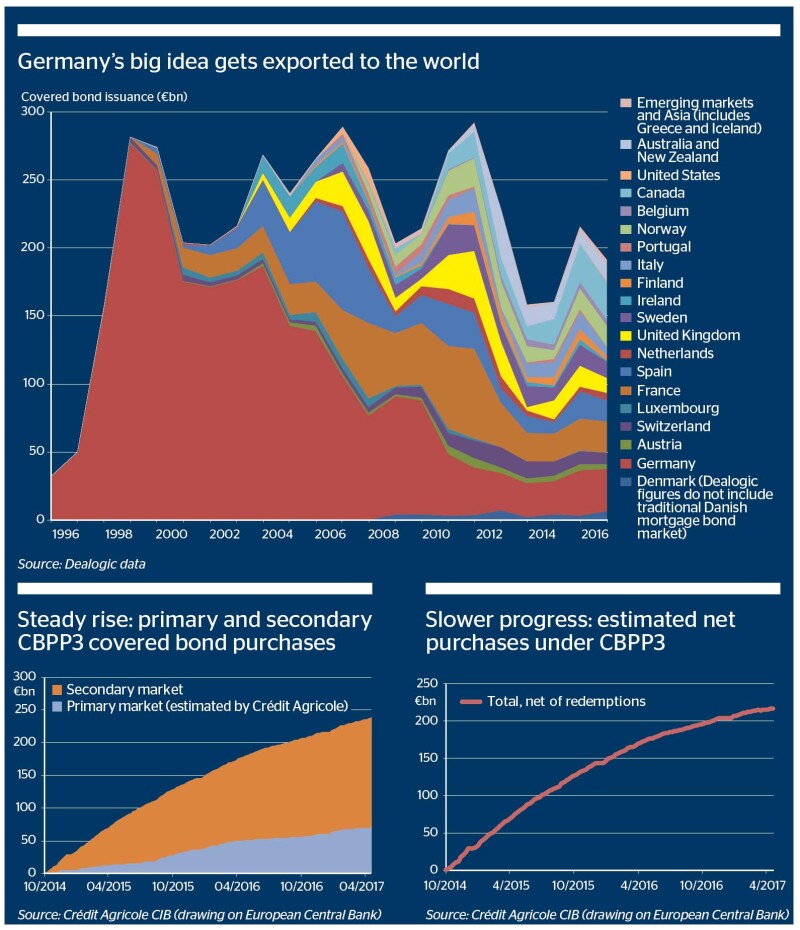

The roots of the covered bond market date back to the 1750s, but in practice the first benchmark deal was not issued until 1995. The market expanded rapidly over the next 20 years and by 2016 outstanding volume stood at €2.5tr, according to the European Covered Bond Council, which says there are well over 300 active issuers spanning 30 countries.

Volumes spiked in 2011 during the sovereign credit crisis when publicly syndicated supply tipped €175bn. But in the last five years issuance has ranged between €100bn and €150bn.

The cheap financing offered under the European Central Bank’s first and second targeted long term refinancing operations (TLTRO), respectively undertaken in 2014 and 2016-2017, lowered the need for market-based funding that covered bonds would have provided. Borrowing under the first operation amounted to more than €200bn and in the second series of TLTROs, which finished in March this year, a total of €740bn was borrowed.

The first wave of TLTRO refinancing is scheduled to hit the market towards the end of 2019, but it is likely banks will want to make the process as smooth as possible and start pre-funding, using covered bonds as they are the next cheapest alternative, from late 2018. But, according to Armin Peter, global head of syndicate at UBS in London, banks will also be striving to meet their total loss absorbing capacity (TLAC) ratios set out by the Financial Stability Board.

Just as covered bond volumes fell with the introduction of the TLTRO and Funding for Lending Scheme (FLS), he says the market “might lose out again because banks will be concentrating on meeting their TLAC ratios”. These need to be fully in place no later than 2022. Even though covered bond volumes are likely to improve due to the refinancing activity of the TLTRO and Term Funding Scheme (TFS), Peter does not expect volumes to return to the peak of 2011.

Profitable business

In spite of this more modest growth outlook the business is expected to remain profitable for arranging banks. On average, fees are around 20 cents, depending on maturity and region. Fees have shrunk in Germany and France, where issuers have managed to renegotiate discounts on the proportion of their deals placed with the ECB’s latest covered bond purchase programme (CBPP3).

Boudewijn Dierick, head of flow ABS and covered bond structuring at BNP Paribas, says: “Covered bonds is still is a profitable business, even with lower volumes and even though there is pressure on fees.”

Fees have also been compressed because deals have been mandated to larger groups of joint lead managers. This is usually driven by the hope of winning reciprocal business, and is not always based on the ability of a lead manager to distribute and sell a deal.

However this development carries concerns. “There is a risk that if you put in four banks with not much experience or ability to support the deal then your future spread may be affected,” says Dierick.

With the ECB practically backstopping all covered bonds with CBPP3, eurozone issuers have become more certain about deal execution. But as many people expect the ECB to start tapering covered bond purchases from early 2018, its support cannot be counted on in future.

“I would like to see execution conditions getting tougher — and less pure reciprocity plays for banks who very evidently have no skin in the game at all,” one banker tells GlobalCapital, adding that he was positively surprised by “the natural profitability of the business”.

The loss of fees has partly been compensated for by a change in the cost of running the business. In the past, top tier banks would often employ specialist covered bond syndicate managers, originators, trading teams of up to five or six people, as well as structurers, who were responsible for putting an issuer’s covered bond programme together.

Banks that still have structuring teams, such as BNP Paribas, have folded them in with the ABS business. Where trading is still offered it is usually conducted by one or two dealers who often double up and trade SSAs, or sit alongside other FIG traders. Syndicate and origination now sit inside the FIG team so there is only one person facing the client.

“There used to be quite a lot of pure covered bond specialists,” says Dierick. “But I think resources are now more or less where they need to be in the industry.”

The profitability is in large part earned by top tier banks that identify synergies and can still provide a good service. However, banks further down the pecking order are more likely to feel the pinch of fee erosion “and it may become a question as to how you are going to offer a breakeven business in the medium term,” warns Patrick Seifert, head of FIG and SSA origination at LBBW in Stuttgart.

Covered bonds are not set for much growth or profitability in financing public sector assets. This low margin business helped the market’s expansion after 1995 but, Derry Hubbard, global co-head of debt capital markets at Danske Bank in Copenhagen, says that part of the market may not return. “In the 90s and early noughties the key focus was expanding the investor base via the SSA franchise and you had issuers like Depfa, Compagnie de Financement Foncier and Dexma that were big in the public sector market — but that dynamic has eroded over time.”

Covered bonds are a bank funding product which Hubbard says “are still a true alternative to agencies,” something which he says senior unsecured will never be. “People want to buy covered bonds because they’re excluded from bail-in, and because it is incredibly simple from a collateral perspective.”

The covered bond structure could be used to fund many types of assets though for some this would present unnecessary and unwarranted complications.

Notwithstanding that, the European Commission may pave the way for a new type of structure — the European Secured Note (ESN). Like covered bonds, the ESN would have dual recourse features, but in contrast it might be secured on a wide range of assets including loans to small and medium sized companies.

“Development of the asset class will depend highly on whether it gets regulatory recognition — in terms of Ucits compliance — and whether it can offer transparency and market liquidity,” says Benjamin Behnke, director of fixed income syndicate at LBBW in Stuttgart.

He says the market is still at an early stage and while some are open to the idea, there are questions whether the assets would be better off funded through a securitization. He says “achieving preferential treatment would be a prerequisite for a broad market acceptance of the ESN”.

Another possible growth area is green covered bonds, with three deals so far. Siefert says issuers must be prepared to offer a green covered bond at the same spread as a conventional deal. “Does that mean there is no value in the green feature? No. What it means is ECB policy has killed differentiation to a large extent and taken away the incentive for issuers to move into that direction.”