Quebec's largest ever euro trade hit screens alongside an €8bn monster dual tranche from the European Financial Stability Facility (EFSF). In dollars, the Asian Development Bank also broke its size record with a $4bn deal alongside a tightly priced deal from the European Bank for Reconstruction and Development (EBRD).

EFSF's giant trade received praise in all categories, but none more so than timing. Coming in the wake of the first round of the French election in which arch Eurosceptic Marine Le Pen came up short against centrist Emmanuel Macron, investors were bullish on the Eurozone's future and the trade received astonishingly strong demand. It also received the week's best score for performance, well deserved following an astonishing 12bp tightening during the week.

ADB's $4bn effort commanded high scores in all five categories.

Quebec's record breaking euro trade received excellent scores for performance, timing and structure but underperformed the average in the pricing category.

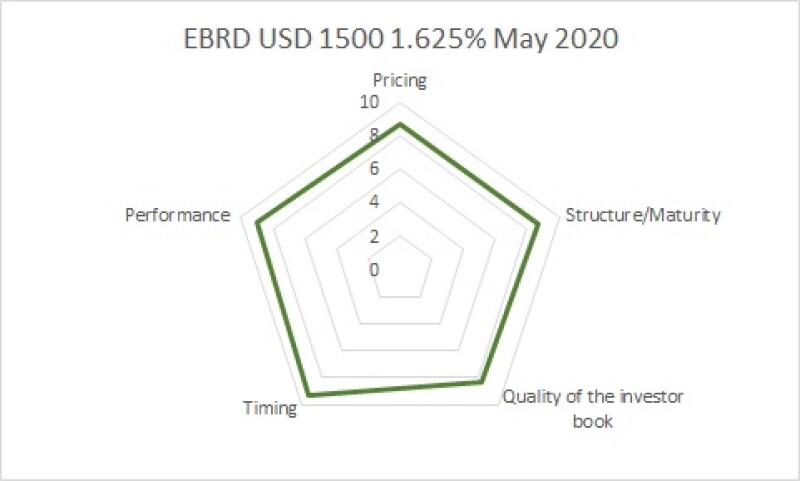

EBRD, like all last week's deals, also drew praise for its timing, coming in the midst of the relief rally following the first round of the French election.

See the bond comments for the deals here.