Just take a look at this week. France’s government bond spreads resembled a puffer fish — as far-right presidential candidate Marine Le Pen huffed and puffed with election promises they blew out. but they contracted just as quickly when a poll said she has little chance of winning power.

Compare and contrast with Spain, now viewed as a safe haven among periphery credits. As France roiled this week, the Community of Madrid sold a strong €1bn 10 year bond issue — unthinkable just a few years ago.

One could point to the example of the Netherlands, fretful over the prospect of the right wing Freedom Party gaining the highest share of the votes in its general election in March. But unlike the French election, where Le Pen will be president if she wins the vote, the Freedom Party would need the support of other groups to win power. All of them have said they will not work with Geert Wilders and his party.

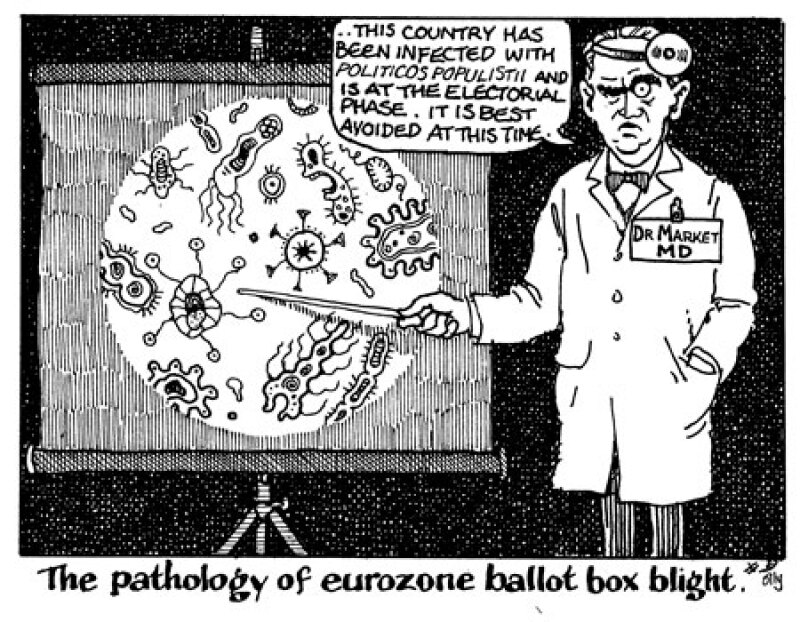

But as has been seen in the UK with the Brexit verdict and in the US with Donald Trump's election win, the previously unthinkable can happen. The trend is clear — political risk will be public sector borrowers’ biggest headache for years to come.