Issuers from around the world have taken advantage of the Formosa bond market in recent months. Verizon Communications sold the largest deal of the year so far in January, bagging $1.475bn. AT&T was not too far behind with a $1.43bn outing, while Pfizer raised $1.065bn from a Formosa bond.

A number of financials from Europe and the US too tapped the Taiwanese market for their funding this year.

Asian issuers, on the other hand, are conspicuous by their absence. In addition to Kookmin, and excluding Japanese credits, only one borrower from each of Hong Kong and Singapore has raised Formosa debt worth a total of $575m year-to-date, according to Dealogic. In comparison, US issuers have bagged a collective $9bn from 13 trades, UK issuers $2.2bn from five bonds. Firms from the UAE and France have also raised north of $1bn apiece from new issuance this year.

The numbers for Asia are also in contrast to the same time last year, when two South Korean names and three from Singapore raised a total of $1.165bn, shows Dealogic.

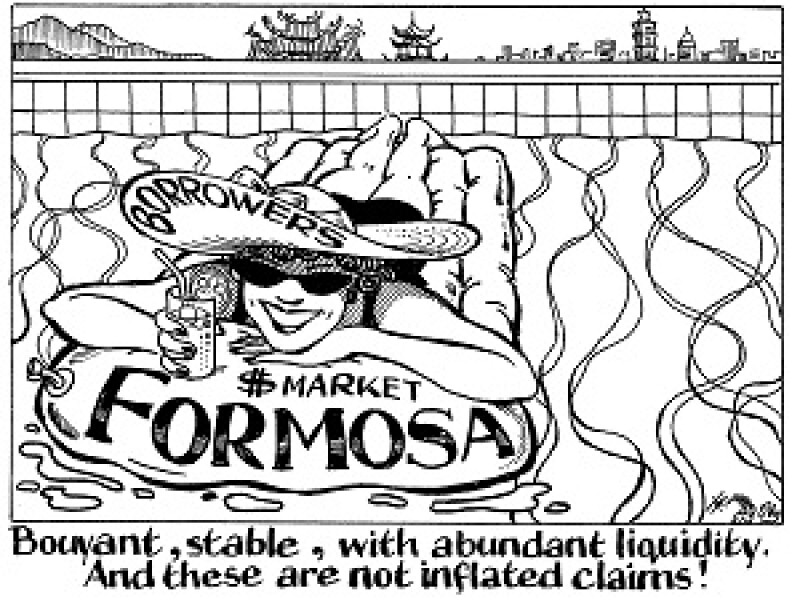

But it is time more Asian issuers look to Taiwan for their fundraising as the benefits are plentiful.

For firms looking for some diversity in their funding sources, Formosa may be the way to go. Investors have abundant dollar liquidity as Kookmin found with its trade. It went in looking for $300m but found enough demand to raise $400m. And the recent success of non-Asian issuers shows the market also has the strength to support billion-dollar-plus trades.

Taiwan’s bank lenders have long been the go to source of liquidity in the Asian syndicated loans market. Replicating that success in the Formosa bond market can be fruitful.

In addition, somewhat tempered secondary trading in the Formosa bond market can also be beneficial. Bankers say that in general, Formosas don't trade beyond a 5bp range in secondary. While this means that bonds won’t benefit from significant tightening in secondary, they will also be relatively immune to any widening of spreads.

This stability can be positive when compared to the broader Asia dollar debt market, which can be more susceptible to geopolitical tensions in South and North Korea and Japan, as well as the dispute around the South China Sea. Of course, spreads on dollar Formosa debt can also be impacted if tensions flare up between Taiwan and China, but that — for now — does not appear to be a major concern.

Not for all

On top of that, Taiwan’s Financial Supervisory Commission has announced new rules effective this month that lifers can only invest in international Taiwan-listed bonds that have a non-callable period of at least five years in primary or at least three years in secondary. This means that borrowers targeting Taiwan will have to lengthen the non-callable period of any new issuance in line with the new regulation.

This doesn’t necessarily mean issuers will have to pay a higher yield on dollar Formosa bonds. While longer tenors may increase the yield on offer, it is somewhat mitigated by the removal of a short-term call option, which could lower the yield.

According to a Moody’s note this week, the expectation is for bond yields to decline from the current 4.5%-5.5% for 30 year international bonds without restrictions on callable periods — but the fall will be mild given the expectation of a US rate hike.

Nevertheless, high rated Asian names heading to Taiwan can be almost guaranteed to find strong demand, as international bonds still offer a substantial premium to the buy-side over domestic alternatives. It’s time for borrowers to make the leap.