Argentina

-

South American supra is hitting its operational and lending targets

-

Under 9% of holders of Argentine oil producer’s 2021s will swap into longer-dated debt

-

-

Operator of 35 airports waives minimum exchange condition as take up stays below target

-

Argentine utility’s debt swap qualifies as distressed, Fitch says

-

Just 8% of holders of CGC’s 2021s have agreed to participate

-

AA2000 has commitments for vital new funding but first needs higher take-up in bond swap

-

-

Political woes compounded by risk-off day in markets

-

Argentine oil and gas company looking to chip away at near-term maturity after Sinopec acquisition

-

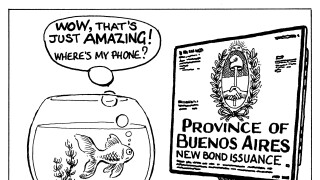

Argentine province already has the approval of 63.7% of its bondholders

-

Shunted bondholders feel the Province of Buenos Aires’ coercive negotiation tactics will hurt its reputation in credit markets, but investors rarely have such long memories