ANZ

-

While bankers in the Northern hemisphere plan well-deserved summer breaks, the Australian and New Zealand dollar markets are set to remain open for business, with some competitive pricing on offer.

-

Hexaware Technologies, an Indian software company majority owned by Baring Private Equity Asia, has mandated nine banks for a $600m take-private loan.

-

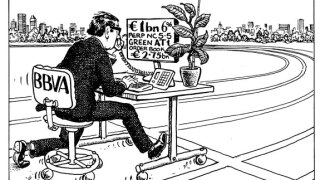

BBVA has become the first bank to print a green additional tier one (AT1) deal. When it was issued this week, it proved that the demand for socially responsible investments (SRI) extends to the riskiest of asset classes, meaning other banks are certain to bring out their own versions of the trade, writes David Freitas.

-

Bank of Communications Financial Leasing Co priced a $800m dual-tranche deal on Tuesday. While it initially wanted to sell just a floating rate note, it added a fixed rate portion too due to investor interest.

-

Cigarette packaging producer Amvig Holdings has made a rapid comeback to the loan market for a HK$1.35bn ($174m) borrowing.

-

Swiss Re debuted in Asia this week with a S$350m ($251.67m) bond that established the European reinsurer in the Singapore market. It also paved the way for more issuance from the firm.

-

The Nordic Investment Bank dropped into a busy Kauri market that has so far seen NZ$1.3bn ($835.8m) of SSA deals this month.

-

The Airport Authority Hong Kong has boosted the size of its loan to HK$35bn ($4.5bn), after receiving a strong response during syndication.

-

The Nordic Investment Bank raised NZ$400m ($260.9m) with its return to the Kauri market on Tuesday, as it prepares to wind down its funding ahead of the summer break.

-

CLP Power Hong Kong has added $750m to its coffers from a dual-tranche bond, taking advantage of the hot demand for its subsidiary’s recent issue to attract investors.

-

Kommunalbanken snagged NZ$500m ($324.5m) on Friday with the second largest Kauri bond of the year. Interest in the New Zealand dollar is high, with NZ$1.1bn worth of SSA Kauri deals printed so far this month — and more are set to follow.

-

ANZ has appointed former loan syndications banker Nancy Wang to the newly created position of director of sustainable finance, international.