Americas

-

◆ 'Great result' for Dutch agency ◆ Capped size, social label helpful ◆ CDPQ brought 'very interesting' deal the day before

-

Transaction is expected to close this week

-

Quadruple helping for investors comes after a busy week at the start of September

-

Huge financial support eases Pemex's immediate debt risks, but does not cure operational problems

-

UBS headquarters among deals in enthusiastic SASB market

-

The sovereign has issued well over $10bn in just two days to fund liability management for Pemex

-

◆ Priced over Austrian govvies ◆ Scarcity and business model help demand ◆ Saskatchewan targets 10 year

-

Banker had worked at DB for 14 years

-

◆ Choice of three or five year tenor considered ◆ 'Intensive schedule' of investor meetings pays off ◆ Other CAD issuers likely to be 'inspired' by deal

-

Authorities are trying to re-establish Pemex as a standalone issuer

-

US FIG issuance spikes above $90bn ahead of expected Fed rate cut

-

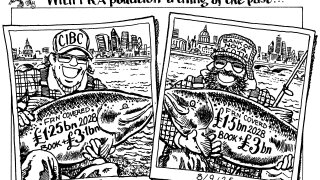

Market participants hope more jurisdictions will follow as Canadian duo attract record demand