Americas

-

One of Argentina's strongest corporate issuers begins investor meetings for proposed seven year

-

◆ BFCM becomes first French bank to print Yankee after parliamentary election ◆ Foreign banks rush before major US peers expected to swarm market ◆ Athene raises dollars days before pulling a euro deal

-

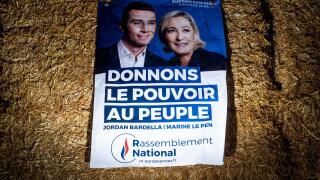

Issuers both land big books as market quickly shrugs off French election volatility

-

Commercial lender becomes seventh Chilean FI with bonds outstanding in Swiss francs

-

The country does not need to issue again overseas this year

-

As supply becomes scarcer, it will be easier for companies to sell dirty debt as green

-

The sovereign has issued more ESG debt than any other emerging market government

-

Corporate-focussed Banco Internacional wants to be the seventh Chilean bank to issue in Switzerland

-

Local and international buyers support Brazilian firm's return to bond markets

-

◆ Foreign FIG issuance so far in 2024 outstrips last year’s volume by more than $20bn ◆ Multiple Canadian and Japanese lenders print ◆ US banks prepare capital plans after the Fed’s latest stress tests

-

Committee featuring at least five major firms’ lawyers set up amid hopes for change in Venezuela

-

Highly rated names land smooth trades after investor demand showed signs of weakness for corporates last week