Americas

-

A pipeline of sovereigns looking for yen bonds awaits

-

Fernanda Guardado hired after Gustavo Arruda left for Mastercard

-

◆ Rare deal pairs payouts in the same tenor ◆ €1.5bn also raised in longer tranche ◆ No cannibalisation

-

Domestic investors dominate shorter tranches, foreigners support longer bonds as Mexico hits size target

-

Final burst of issuance struck this week before expected dearth begins

-

Central American supra has cut interest rates on loans to its members as it has gradually reduced its own cost of funding

-

Federal Reserve's Jackson Hole meeting, which begins on Thursday, has market’s attention as 50bp September rate cut expected

-

Over Sfr1.45bn printed in two days as Roche, Geberit, CCDJ and Equinix all hit the market

-

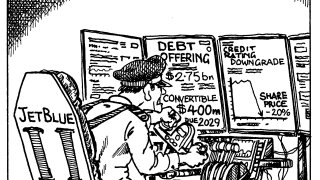

US airline issues convertible first thing Monday morning after last week’s volatility, then sees shares nosedive

-

Missing US issuance could return to feed European investors ‘crying out’ for supply

-

US drugmaker's multi-tranche deal kicked off a week heavily front-loaded with deals

-

Belief the Fed will cut rates by 25bp to 50bp in September hold firm