Africa

-

CBoM follows Nigeria and Egypt in trading below reoffer as US Treasuries sell off

-

Cocobod's syndicated loan priced 65bp inside its 2020 deal

-

Majority of holders of 2026s agree to push out maturity date

-

EM sovereign's dollar deal could reach $4bn

-

Rand Merchant Bank claims "first of its kind" to be arranged by an African bank

-

Nigeria took a bold step on Tuesday, bringing three tranches of dollar paper to a turbulent market

-

Jeffrey El Khoury joins the US bank from SocGen to replace James Sadler

-

A market that has in previous years promised much but delivered little seems finally to be growing thanks to sovereign issuance

-

Market participants are preparing for an imminent trade from Nigeria, after the government confirmed it was eyeing a September bond

-

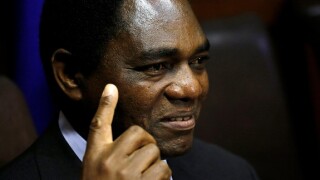

Restructuring of emerging market debt is back on the agenda this week, as defaulted Zambia’s election saw ‘market friendly’ Hakainde Hichilema secure the country’s presidency. The nature of its forthcoming Eurobond restructuring, which some say could act as a benchmark for other emerging market sovereigns, is expected to become clear within weeks

-

Investors are looking forward to a bond from South Africa, after an almost two year hiatus, following a global investor call on Friday

-

Hichilema victory surprises bond investors with new government expected to be more market friendly