Africa Loans

-

The speed and success of Sibanye Gold in closing a loan to back its acquisition of US palladium miner Stillwater, has put South Africa in focus for bankers amid talk that two other acquisition deals out of the country could follow soon.

-

Sibanye Gold, the South African gold producer, confirmed a surfeit of lending demand at bank meetings on Thursday as it wrapped up final commitments for loans backing its acquisition of US palladium miner Stillwater.

-

The African loan market has hit 2017 on the front foot, with bankers heralding the support shown for Kenya and Sibanye deals as testament to gathering confidence in the region — but only for the right credits.

-

Kenya has mandated four banks to arrange internationally syndicated loans of as much as $800m, ending a restless wait for competing lenders.

-

Sibanye Gold, the South African gold producer, has set a date for bank commitments as it targets a quick turnaround on a loan backing its acquisition of US palladium miner Stillwater.

-

Industrial and Commercial Bank of China has bolstered its loan syndication and sales effort in London with a hire as the bank looks to establish a stronger foothold in the Europe, Middle East and Africa market.

-

Loan bankers have been waiting on tenterhooks for Kenya to reveal a mandate for deals totalling as much as $1bn, with the country’s government having originally been set to make the announcement this week.

-

Syndication of the acquisition financing loans for Lonza and Sibanye Gold is expected to begin soon, as loans bankers begin 2017 in an optimistic mood.

-

The global rise in dollar funding, combined with political upheaval and the heavy depreciation of the lira are destroying some of the historically borrower-friendly terms available in the Turkish loan market. Elly Whittaker reports.

-

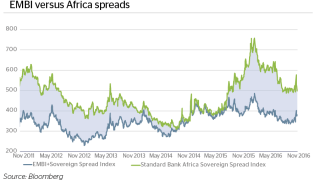

While some cash-strapped borrowers in Africa will bite the bullet and pay up to access international bond markets in 2017, others will have to return to the loan market for support. Virginia Furness and Elly Whittaker report.

-

South African gold miner Sibanye has agreed to buy US palladium miner Stillwater for $2.2bn and will raise a $2.7bn loan to pay for the acquisition. Sibanye joins South African borrowers Steinhoff and Aspen in raising large loans for M&A this year.

-

The longer dated tranche of African Export-Import Bank’s (Afreximbank’s) two and three year loan received the most commitments in general syndication even though it was the first time the borrower borrowed at such a long tenor.