AfDB

-

West African development bank has sold two private hybrid bonds and is planning a public deal

-

Largest ever book in the currency for the issuer, which priced well inside secondary levels

-

New asset class firmly established as AfDB achieves the investor base and pricing it wanted, says treasurer

-

Banque Ouest-Africaine de Développement's deal in December will be followed by more this year

-

The ready and the willing should ride the African Development Bank’s wave while they can

-

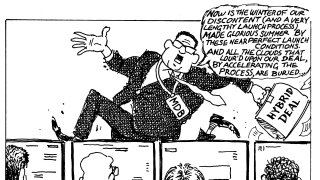

The multilateral lender is set to take $750m from a new type of product for SSAs

-

EIB to test 15 year demand as agencies eye euros and dollars

-

EBRD and BNG are both met with unprecedented demand

-

Issuer keeps an open mind but there is unlikely to be a ‘huge chance’ of the hybrid deal being done this year

-

AfDB and Kommuninvest stay in the three to five year part of the curve

-

Public sector borrowers will slip into the market ahead of the US Thanksgiving holiday on Thursday

-

'Large range' of investors interested in new asset class, says treasurer